Starting a non-profit requires a formal ngo registration in india to gain legal recognition and donor trust. This guide covers the ngo registration process for trusts, societies, and section 8 companies to ensure compliance. You will learn about ngo registration fees, required documents, and ngo trust registration to secure funding easily. Follow these expert steps to obtain your ngo registration certificate and create a lasting social impact today.

What Is NGO Registration & Why It Is Legally Mandatory in India

NGO registration is the official process that transforms a social group into a legitimate legal entity in India. It is mandatory for organizations that want to open bank accounts or receive government and corporate funding. Without this legal status, founders are held personally liable for all financial and legal issues within the organization. Registration ensures your mission survives independently of the original founders and maintains a permanent, recognized legal identity. You must complete the ngo registration online to access essential tax benefits like the 12A and 80G certifications.

Legal recognition allows your organization to enter into contracts and own property in its own specific name. Public trust increases significantly when donors see that your NGO is a registered and fully transparent organization. An unregistered group cannot legally issue donation receipts, which makes it very difficult to attract major financial support. Registration is also a mandatory prerequisite for accepting foreign contributions under the strict Foreign Contribution Regulation Act. It protects your team from personal accountability during any legal or financial disputes that might occur later.

Official status makes you eligible to apply for various welfare programs and financial assistance from the government. It also ensures that your organization follows a clear internal structure with defined rules for management and operations. A registered NGO can participate in national level partnerships and collaborate with other large international social organizations. This permanent identity is necessary for building a long-term reputation and impact in the Indian social sector. You should prioritize the ngo registration process to establish a solid foundation for your charitable or social mission.

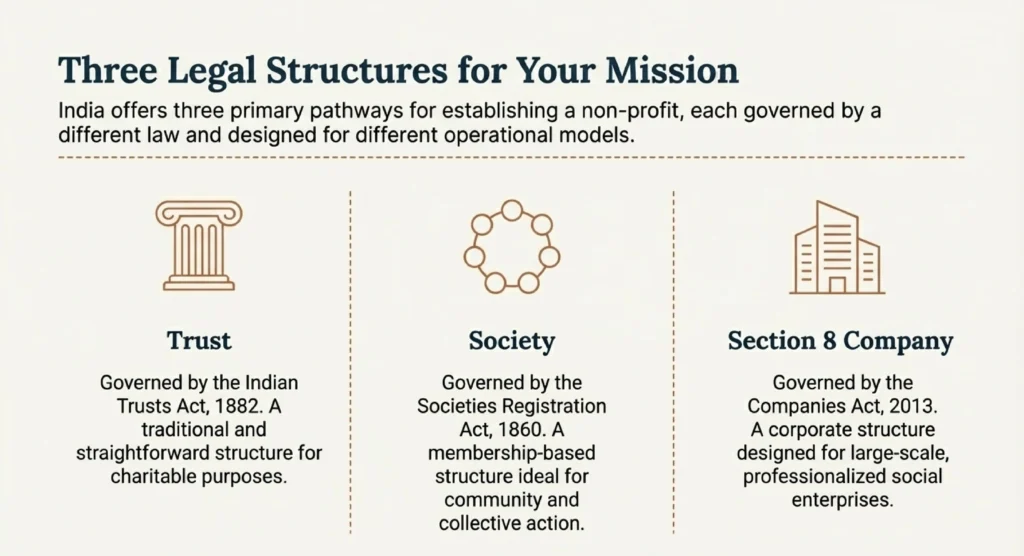

Trust vs Society vs Section 8 – Which NGO Structure Is Right for You?

Choosing the correct structure for your mission is the most important part of the ngo registration process. A trust is ideal for small initiatives while a society is better for democratic, member-driven community welfare projects. Section 8 companies offer a professional corporate structure that is highly favored by large-scale donors and international partners. Each legal form has different requirements regarding the minimum number of members and annual regulatory compliance standards. You must evaluate your long-term goals and funding needs before deciding on the specific type of registration.

Comparison Between Trust, Society & Section 8

| Feature | NGO Trust Registration | Society Registration | Section 8 Company |

|---|---|---|---|

| Governing Law | Indian Trusts Act, 1882 | Societies Registration Act, 1860 | Companies Act, 2013 |

| Minimum Members | 2 Trustees | 7 Members | 2 Directors |

| Best For | Small/Family Charitable Projects | Community/Civic Initiatives | Large-scale National Projects |

| Structure | Informal and simple | Democratic and flexible | Professional and corporate |

| Compliances | Low regulatory burden | Moderate requirements | High regulatory standards |

A trust provides a centralized management style which is perfect for founder-led or family-driven charitable philanthropy missions. Societies offer more operational flexibility and are preferred for civic, scientific, or cultural projects involving many local members. Section 8 companies provide limited liability protection to their directors and are viewed as highly professional by corporations. While the ngo registration fees vary for each type, the benefits of legal credibility remain the same. Understanding these differences will help you select the structure that ensures the sustainability of your social work.

The ngo registration in india for a trust is usually faster and requires much less initial paperwork. Societies require more members and a formal governing body to manage the daily activities and democratic voting processes. Section 8 companies are registered through the Ministry of Corporate Affairs and follow strict corporate governance and audit rules. Each structure has its own unique advantages regarding tax exemptions, property ownership, and eligibility for various grants. Choosing wisely at the start prevents future legal complications and helps in achieving your organizational vision efficiently.

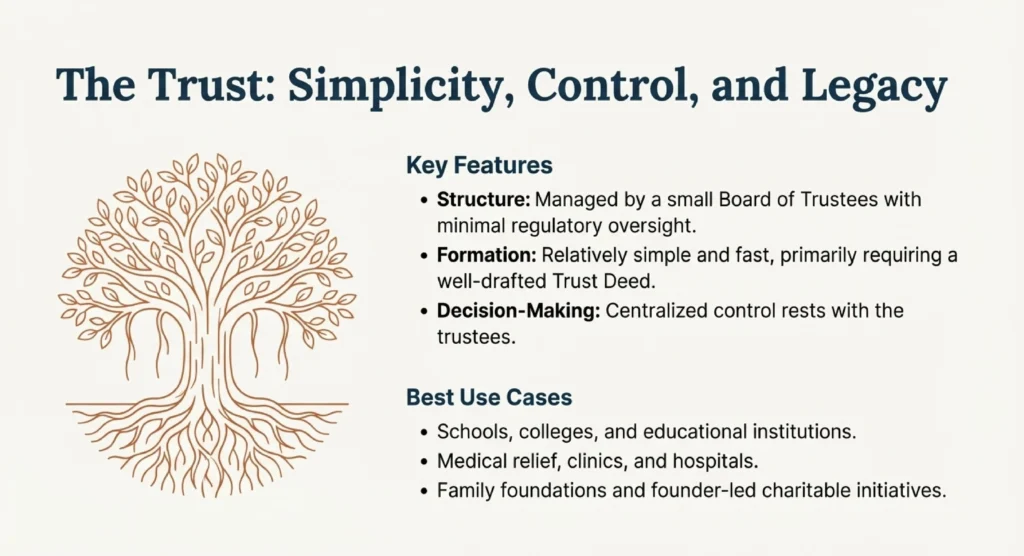

Trust Registration for NGOs – Structure, Benefits & Limitations

NGO trust registration is governed by the Indian Trusts Act of 1882 or various state-specific public trust acts. This structure is very popular for family-led initiatives and small charitable projects like schools or medical relief centers. It requires at least two trustees who manage the assets for the benefit of the public or society. One major benefit is the lower compliance burden compared to the more complex society or section 8 models. However, the centralized control might limit the democratic involvement of a larger group of members in the organization.

The ngo registration process for a trust involves drafting a trust deed on non-judicial stamp paper for official submission. This deed outlines the objectives, rules for meetings, and the specific duties of all the appointed trust members. Once registered, a trust becomes a permanent legal identity that can hold property and enter into legal contracts. It is an excellent choice for running orphanages, old age homes, or community-based healthcare and educational initiatives. Most founders prefer this route because it allows them to maintain a close-knit vision for their social cause.

You can find more details on 12A and 80G Registration for NGOs to improve your funding. A trust can also apply for foreign funding once it obtains the mandatory registration under the FCRA guidelines. While it is simple to form, a trust must still maintain audited accounts if it receives significant grants. The simplicity of governance makes it ideal for individuals who want to start charitable work without heavy administrative. Despite the limitations on member participation, it remains the most traditional and cost-effective way to launch an NGO.

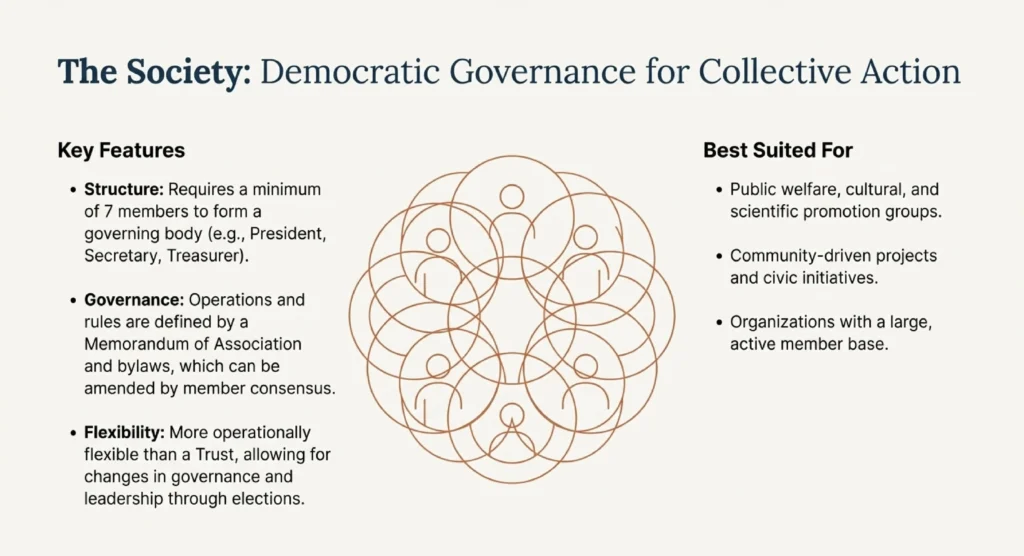

Society Registration for NGOs – Governance, Control & Suitability

Societies are registered under the Societies Registration Act of 1860 and require a minimum of seven founding members. This model provides a democratic structure where members elect a governing body to manage the organization’s daily operations. It is best suited for cultural, scientific, or large community welfare projects that require broad participation and flexibility. Societies allow for easy amendments to bylaws, making them highly adaptable to changing social needs or project goals. You must ensure that the ngo registration form for a society includes a clear memorandum and distinct bylaws.

The governing body of a society typically includes positions like the president, secretary, and a dedicated treasurer for finance. This structure is highly suitable for alumni associations, sports clubs, or local community welfare and civic development groups. While societies offer flexibility, they also require more compliance, such as holding annual general meetings for all its members. The legal status of a society ensures that the organization can own assets and sue or be sued. It is a preferred choice for activists who want to build a movement with shared leadership and accountability.

Registering a society requires a board resolution that documents the consent of all members and their assigned official roles. You must file the identity and address proofs of all seven members with the state’s Registrar of Societies. The approval process is generally transparent and involves a thorough review of the organization’s proposed rules and regulations. Societies are eligible for government grants and can also apply for the essential 80G tax benefits for donors. This model fosters a sense of community ownership and collective responsibility for the organization’s various social welfare activities.

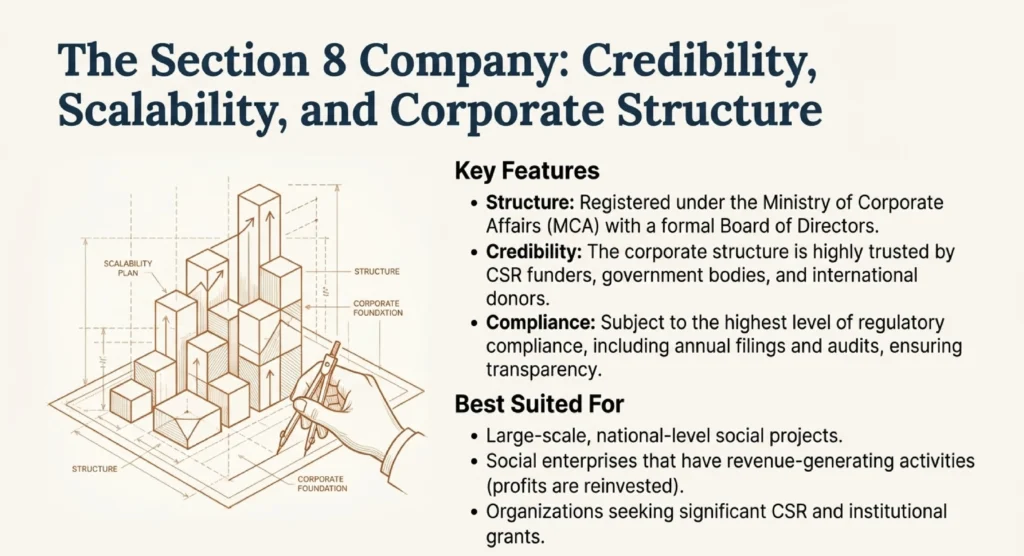

Section 8 Company Registration – Corporate Structure for NGOs

vA Section 8 company is registered under the Companies Act of 2013 and offers the highest legal credibility. It requires at least two directors and is perfect for large-scale operations that need significant fundraising and transparency. This corporate structure makes it much easier to receive corporate social responsibility funds and international donations from abroad. While the compliance requirements are higher, the stability and professional image provide long-term operational advantages for any NGO. You can check ngo registration online through the Ministry of Corporate Affairs portal to verify any registered company.

The ngo registration process for a Section 8 company is entirely digital and managed by the central government. Directors must obtain a digital signature certificate and a director identification number before filing the necessary incorporation forms online. This structure provides limited liability protection, which means that the personal assets of the directors are always legally protected. It is the most preferred structure for institutional projects, national-level NGOs, and organizations that plan to scale rapidly. The professional governance model appeals to corporate boards and international foundations looking for highly transparent partners for funding.

Section 8 companies must follow strict audit rules and file annual returns with the Registrar of Companies every year. They are not allowed to pay any dividends to their members as all profits must be reinvested. This ensures that all the generated funds are used exclusively for the promotion of the NGO’s social welfare objectives. Despite the higher ngo registration fees, the long-term benefits in terms of funding access and credibility are immense. Many modern social entrepreneurs choose this model to build sustainable and professionally managed non-profit organizations in India.

Eligibility Criteria for NGO Registration in India

To successfully complete ngo registration in india, the organization must prioritize social welfare over any commercial or private gain. The founders must draft a memorandum of association that clearly outlines the charitable objectives and governing rules of the entity. Most structures require that all trustees or directors are over eighteen years old and legally capable of entering contracts. For disability-focused initiatives, you must meet specific beneficiary counts under the guidelines of the National Trust Act registration. Every organization must maintain transparent financial records and should not discriminate based on religion, caste, or any creed.

The ngo registration process requires that the proposed objectives are aligned with the legal definitions of charitable social work. This includes activities like poverty eradication, education, medical relief, or the general promotion of science and the fine arts. Founders must also ensure that they have a registered office address located within the specific jurisdiction of registration. For specialized registrations, such as the National Trust, at least twenty beneficiaries must have valid and verified UDID cards. A governing body must be formed according to the minimum member requirements of the chosen legal NGO structure.

Financial eligibility for certain registrations may require a minimum annual income or expenditure of at least three lakh rupees. At least twenty percent of the total income should ideally come from public donations or corporate social responsibility funds. The organization must be prepared to undergo regular audits and provide transparent reports to the relevant government authorities. No part of the NGO’s income or property can be transferred directly or indirectly to its founding members. Meeting these criteria ensures that your application is not rejected and your organization remains compliant with Indian law.

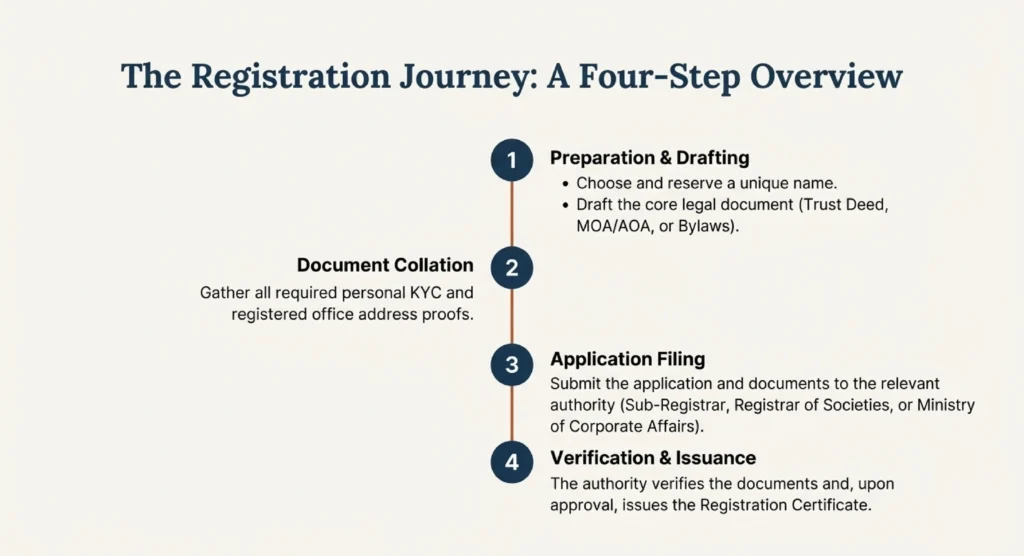

Step-by-Step NGO Registration Process (Trust, Society & Section 8)

The first step in the ngo registration process is choosing a unique name that reflects your social welfare objectives. You must then draft the primary legal document, such as a trust deed or a memorandum of association. For trusts, you must submit the deed to the local Sub-Registrar after printing it on non-judicial stamp paper. Section 8 companies must obtain a digital signature certificate before filing the incorporation forms on the MCA portal. After verification by the relevant authorities, you will finally receive the official ngo registration certificate for your organization.

Societies must apply through the state-specific Registrar’s portal by submitting the identity and address proofs of all members. You should also prepare a board resolution that documents the consent of all members and their specific assigned roles. For a trust, the settlor and trustees must appear in person or virtually before the registrar for document verification. Section 8 companies must file the comprehensive SPICe+ form which includes the memorandum and articles of association documents. Once the registrar or MCA is satisfied with the documents, they will issue the formal certificate of registration.

You can visit the NGO Darpan Portal to register for government grants after your initial setup is complete. This portal acts as a bridge between the government departments and the registered non-governmental organizations across the country. Following a professional step-by-step approach reduces the chances of errors and ensures that your NGO is legally sound. Professional assistance can help you navigate these digital portals and handle the complex legal drafting required for each step. Completing this process correctly is the first major milestone in your journey as a social impact change maker.

Checklist of Mandatory Documents

| Document Type | Details Required |

|---|---|

| Identity Proof | PAN Card and Aadhaar Card of all founders |

| Address Proof | Utility bill or Rent Agreement for the office |

| Photographs | Recent passport-size photos of all trustees/directors |

| Governing Deed | Drafted Trust Deed, MOA, or AOA documents |

| No Objection | NOC from the property owner of the registered office |

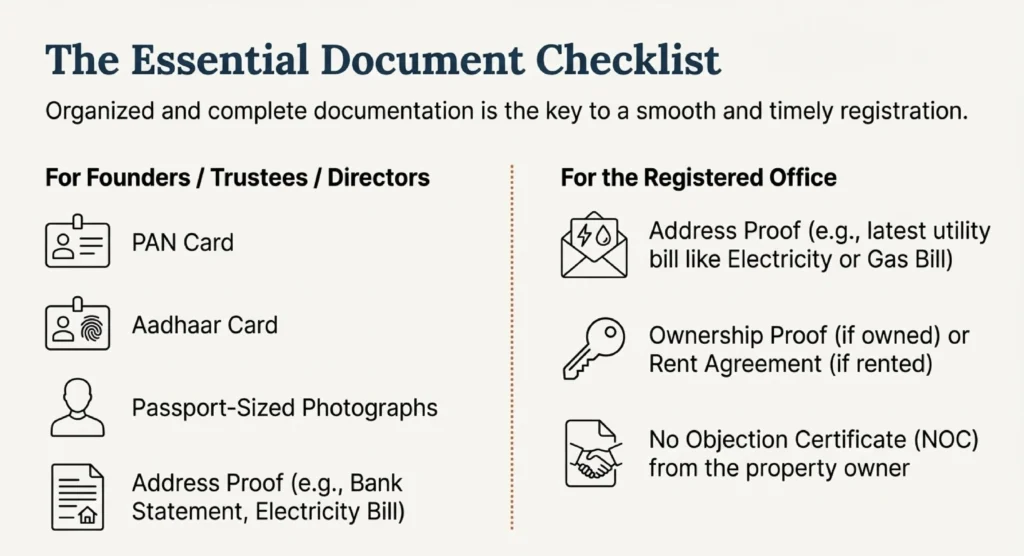

You must provide the PAN cards and Aadhaar cards of all the founding members, trustees, or company directors. Every member must also submit recent passport-size photographs and residential proofs like a bank statement or electricity bill. Proof of the registered office address is mandatory, including an ownership document or a valid, signed rent agreement. If the office space is rented, you must obtain a no objection certificate from the actual property owner. Having an ngo registration process pdf checklist can help you organize these documents before you start the filing.

Societies and Section 8 companies require a drafted memorandum of association and articles of association for the application. A trust requires a legally drafted trust deed that clearly specifies the roles, objectives, and the trust property. You may also need to provide an affidavit confirming the legitimacy of the office address and the unique name. For disability-focused NGOs, a valid RPwD Act certificate is necessary for the specialized National Trust registration process online. Ensuring that all scanned documents are clear and within the required file size is vital for online submissions.

Maintaining a folder with all the original documents is recommended for the physical verification stage if it is required. You must also ensure that all utility bills provided as address proof are not older than two months. The ngo registration form must be filled with extreme care to match the details on the identity proofs. Any discrepancy in the names or addresses can lead to delays or the rejection of your entire application. Preparation is the key to a hassle-free registration experience for any new or existing non-profit organization.

How Long Does NGO Registration Take? (Realistic Timelines)

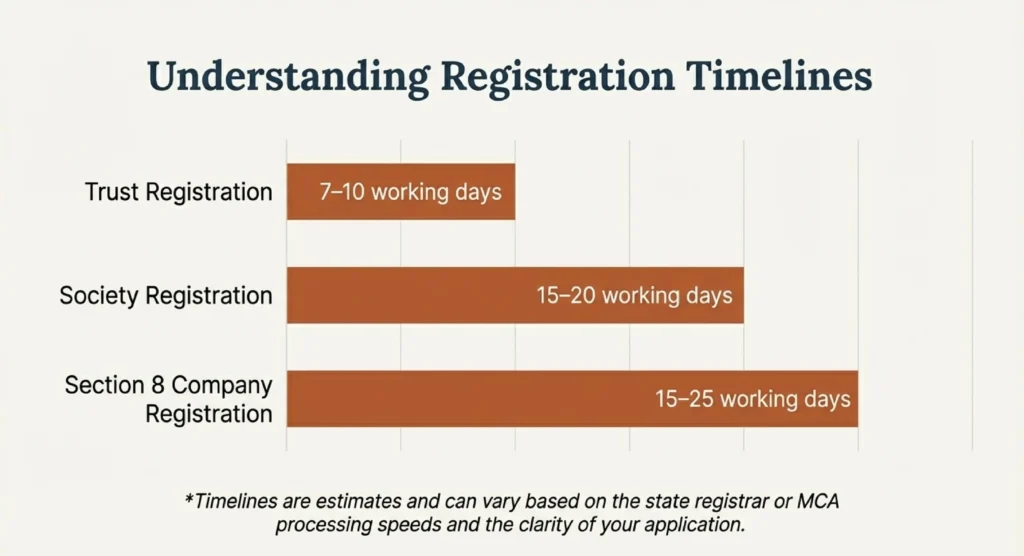

The time required to register ngo online depends heavily on the specific legal structure you choose for your mission. A trust is usually the fastest option and can be registered within seven to ten working days in India. Society registration typically takes between fifteen and twenty days, depending on the response time of the state registrar’s office. Section 8 company registration generally requires fifteen to twenty-five days to complete all the necessary corporate law formalities. Government approval timelines can vary based on the accuracy of your documents and the current workload of the department.

National Trust registration for disability-focused NGOs might take longer due to the specific financial and beneficiary verification requirements. If the registrar requests any modifications, you must respond promptly to prevent the application from being officially rejected. Factors like local holidays and the availability of the sub-registrar can also impact the final issuance of the certificate. It is important to plan your social activities and funding drives according to these realistic legal registration timelines. Professional consultants can often expedite the process by ensuring that all your documents are perfectly filed at once.

Once the initial ngo registration is complete, you will need additional time for PAN and TAN card applications. Applying for tax exemptions under sections 12A and 80G can take an additional three to six months for approval. You should also account for the time needed to register on the NGO Darpan and CSR-1 portals respectively. Being aware of these timelines helps in managing the expectations of your donors and your founding board members. Consistency in follow-ups with the relevant authorities is often necessary to ensure that your application moves forward smoothly.

Common Mistakes That Delay NGO Registration

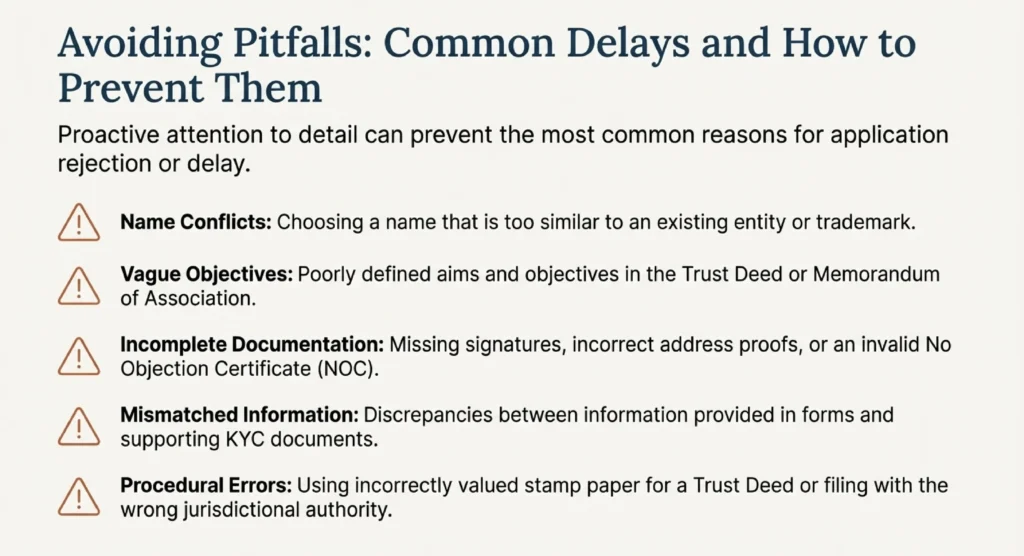

Selecting a name that is too similar to an existing organization will lead to an immediate application rejection. Errors in drafting the trust deed or the memorandum of association often cause significant delays in the approval process. Using the incorrect value of non-judicial stamp paper is another common mistake that can invalidate your entire registration attempt. Failing to provide clear and updated address proofs or missing signatures on the ngo registration form causes delays. You must address any modification requests from the registrar within sixty days to avoid the total cancellation of your application.

Providing expired utility bills as proof of the registered office address is a very frequent reason for filing rejections. Some founders forget to obtain the mandatory no objection certificate from the property owner when using a rented space. For a Section 8 company, errors in the digital signature certificate or the director identification number can stall the process. Incomplete information regarding the charitable objectives or the beneficiary details will also lead to more queries from the authorities. Double-checking all the details before the final submission is the best way to avoid these common legal pitfalls.

Lack of clarity in the bylaws regarding the management of property and funds can cause future legal disputes. Rejection of a specialized registration like the National Trust might require a mandatory six-month wait before you can reapply. Using professional services for ngo registration in delhi or other cities ensures that all these common errors are avoided. Experts can review your documents against the latest government guidelines to ensure a one-time and successful registration. Avoiding these mistakes saves time and allows you to start your social welfare mission much earlier than expected.

What to Do After NGO Registration? (Post-Registration Compliance)

Once you receive your certificate, you must immediately apply for a dedicated PAN and TAN for the organization. Registering on the NGO Darpan portal is essential for applying for various government grants and central welfare schemes. You should also apply for the CSR-1 registration to become eligible for funding from corporate social responsibility programs. Securing 12A and 80G certifications will provide tax exemptions for your NGO and tax deductions for your donors. If you plan to accept international donations, you must apply for registration under the Foreign Contribution Regulation Act.

You should visit the Income Tax Department Portal for more information on tax compliance for non-profits. Maintaining audited financial records is a mandatory requirement for all registered NGOs to ensure transparency and legal accountability. You must file annual returns with the registrar or the Ministry of Corporate Affairs to keep your status active. Holding regular meetings of the board of trustees or the governing body is necessary to document all major decisions. Keeping a minute book and updated member registers is also a critical part of your ongoing legal compliance.

Applying for a dedicated bank account in the name of the NGO is the next vital financial step. This allows for transparent tracking of all donations and expenditures related to your various social and charitable projects. You should also focus on building a digital presence to increase your visibility among potential volunteers and donors. Compliance with local labor laws and professional tax requirements may also be necessary as your organization begins to grow. Staying compliant ensures that your NGO remains eligible for future funding and maintains its hard-earned public credibility.

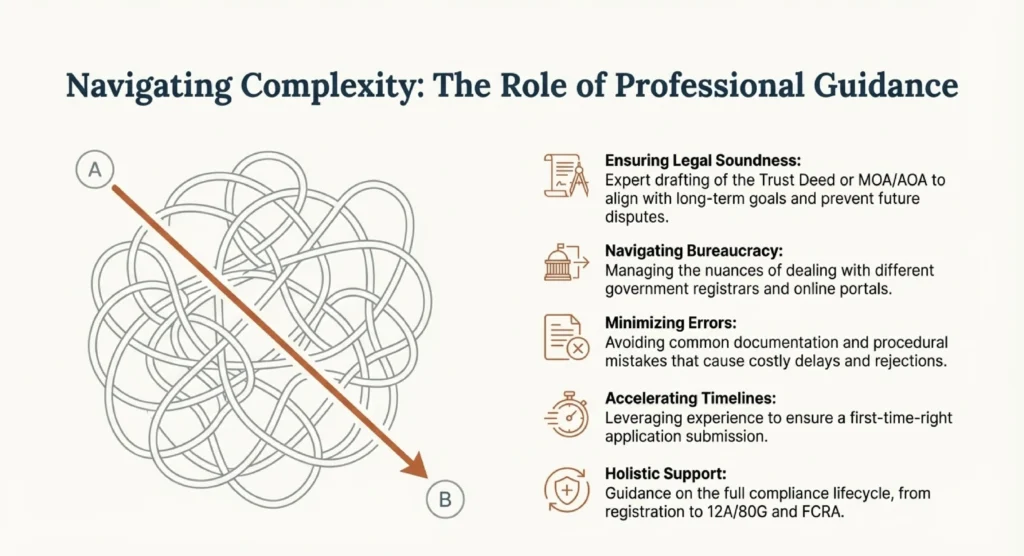

Why Professional Help Matters for NGO Registration

Expert legal assistance ensures that your ngo registration in delhi or anywhere else in India is done correctly. Professionals can help you draft legally sound deeds and bylaws that protect the long-term interests of the organization. They handle the complex digital filing processes and coordinate with government officials to ensure a smooth and fast approval. Many consultants offer a fixed ngo registration fees package that includes all post-registration compliances and tax filings. Using professional services reduces the risk of rejections and allows you to focus entirely on your important social work.

A professional team can guide you in choosing between a trust, society, or a Section 8 company structure. They stay updated with the latest changes in the Companies Act and the various state-specific society registration rules. This expertise is invaluable when dealing with specialized registrations like the National Trust or the complex FCRA approvals. Having a dedicated legal partner provides peace of mind and ensures that all your paperwork is always audit-ready. Professional drafting prevents future internal disputes by clearly defining the powers and the duties of all the founding members.

You can refer to the Ministry of Corporate Affairs for the latest guidelines on Section 8 company compliance. Experts can also assist in the preparation of project proposals for government grants and corporate CSR funding opportunities. They provide ongoing support for annual filings, tax audits, and the renewal of various essential licenses and certifications. This comprehensive support helps your NGO grow from a small local group into a well-recognized national organization. Investing in professional help at the start is a wise decision for the long-term success of your mission.

Common Questions About NGO Registration

To register your NGO, follow these steps: 1. Choose a unique name. 2. Draft a constitution outlining your mission and activities. 3. Gather a board of directors. 4. Register with the appropriate government authority. 5. Obtain necessary approvals. 6. Open a bank account. 7. Fulfill reporting requirements. Check local laws for specific details.

The initial cost to start an NGO varies widely based on factors like location, scale, and activities. It can range from a few hundred to several thousand dollars. Essential expenses include registration fees, legal documentation, and operational costs. Detailed budgeting based on your specific goals and context is recommended.

While it’s possible to operate some nonprofit activities informally without registration, official registration offers several benefits. Registration enhances credibility, facilitates fundraising, and provides legal recognition. However, requirements vary by jurisdiction. Check local laws and regulations to determine if registration is mandatory and to understand the benefits and obligations associated with running an NGO.

The tax treatment of NGOs depends on the jurisdiction and the specific tax laws governing nonprofits in that area. In many countries, registered NGOs enjoy tax exemptions on their income as long as they meet certain criteria and operate exclusively for charitable or social purposes. It’s crucial to consult local tax authorities to understand the tax obligations and benefits for NGOs in a specific location.

Yes. With NGO Partner, you can complete NGO registration online through video KYC, digital signatures, and scanned documents.

1.Trust: 7–10 working days

2.Society: 15–20 days

Section 8: 20–30 days, depending on MCA approval

Yes, professional drafting and filing ensure your application is approved without rejections. NGO Partner has an in-house legal & CA team.

Only after getting FCRA registration. We can help with that once your NGO has completed 3 years or meets the eligibility requirements for prior permission.