What is FCRA? Meaning, Full Form of FCRA

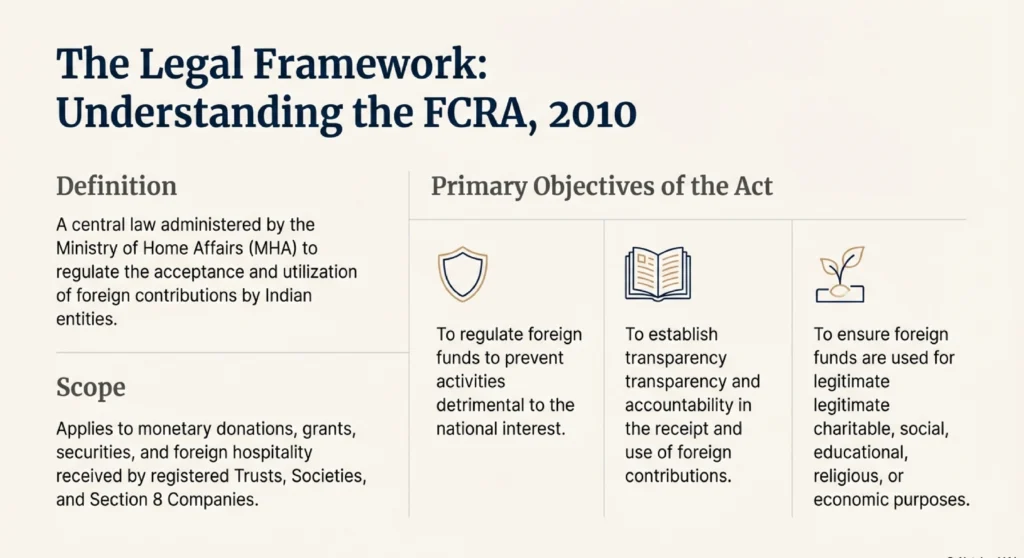

To understand the regulatory landscape for non-profits in India, one must first ask: what is fcra?. The full form of fcra is the Foreign Contribution (Regulation) Act. This fcra law serves as a vital legal framework designed to monitor and manage the inflow of foreign funds into the country. It ensures that any money coming from overseas is used for legitimate purposes and does not harm the nation’s security. Essentially, it is a mechanism to bring transparency and accountability to how non-government organisations (NGOs) and other associations handle international donations.

FCRA Act 2010

Legal Framework and Scope The fcra act 2010 is the primary legislation administered by the Ministry of Home Affairs (MHA). This act regulates the acceptance of foreign hospitality or contributions by individuals, companies, and associations. The scope of the fcra act 2010 is broad, covering monetary grants, donations, and even securities received from foreign sources. It aims to create a structured environment where cross-border financial transactions are scrutinised to protect the sovereignty and integrity of India.

Objectives of the Foreign Contribution Regulation Act

The fcra law has clear, dual objectives. First, it seeks to oversee and manage how foreign funds are utilised for social, educational, religious, or economic development. Second, it acts as a preventative measure to prohibit the use of foreign funds for any activities deemed detrimental to the national interest or public welfare. By mandating reporting through fcra online services, the government ensures that the integrity of the non-profit sector remains intact while facilitating societal growth.

Importance and Significance of FCRA Registration for NGOs

What is FCRA Registration and Why It Is Mandatory

If you are wondering what is fcra registration, it is the formal legal permission granted by the Central Government to an entity to accept foreign donations. Under the fcra act 2010, fcra registration is mandatory; without it, accepting even a small amount from a foreign individual or agency is strictly prohibited and can lead to severe legal penalties. It is the foundational requirement for any organisation that wishes to scale its impact using international resources.

Benefits of NGO FCRA Registration and FCRA Clearance

Securing ngo fcra registration offers several transformative benefits. Primarily, it provides legal authorisation to access international grants and global CSR projects that would otherwise be unavailable. Furthermore, obtaining fcra clearance acts as a badge of credibility, demonstrating to donors and stakeholders that the organisation is transparent and compliant with the fcra law. It also offers legal protection, ensuring the organisation operates within the bounds of Indian law while pursuing humanitarian causes.

Types of FCRA Registration and Eligibility Criteria

Normal FCRA Registration (Regular NGO FCRA Registration)

The most common pathway is the normal fcra registration, intended for established organisations. To qualify for this type of ngo fcra registration, an association must have a proven track record of at least three years in its chosen field. This route allows for the unrestricted receipt of foreign funds for the purposes defined in the organisation’s charter.

Eligibility Criteria for Normal FCRA Registration

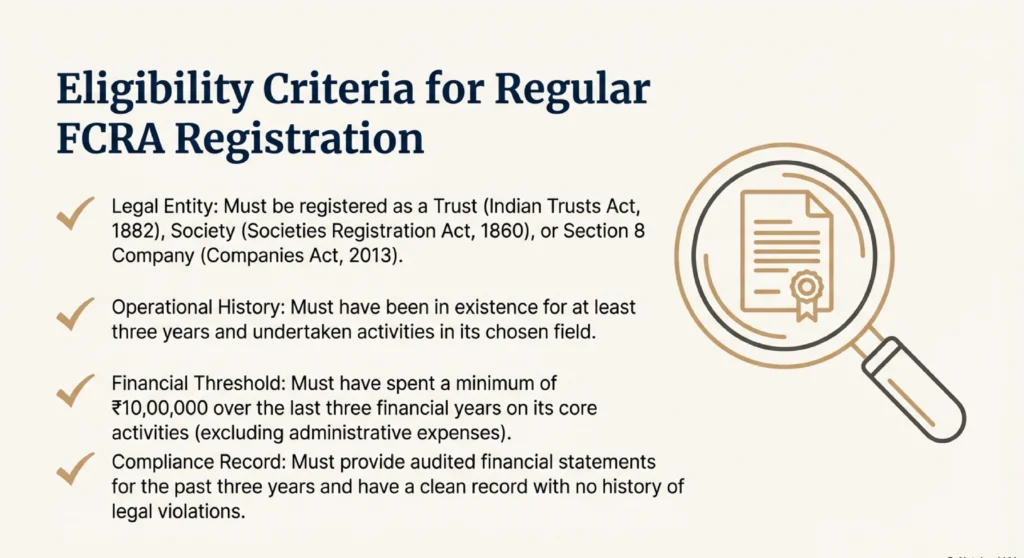

To be eligible for a normal fcra registration, the applicant must be a registered legal entity, such as a Trust, Society, or Section 8 Company. The organisation must have been active for three years and demonstrated a genuine commitment to social upliftment. A key requirement is having a clean track record with no history of misusing funds or engaging in activities that disturb communal harmony.

Financial and Legal Requirements under FCRA Act 2010

Under the fcra act 2010, financial transparency is non-negotiable. For a normal application, the organisation must have spent at least Rs. 10,00,000 (or up to Rs. 1 Crore depending on specific guidelines) on its core objectives over the last three years, excluding administrative costs. Additionally, submission of audited financial statements for the preceding three years is a mandatory part of the fcra online registration.

Prior Permission under FCRA Online Registration

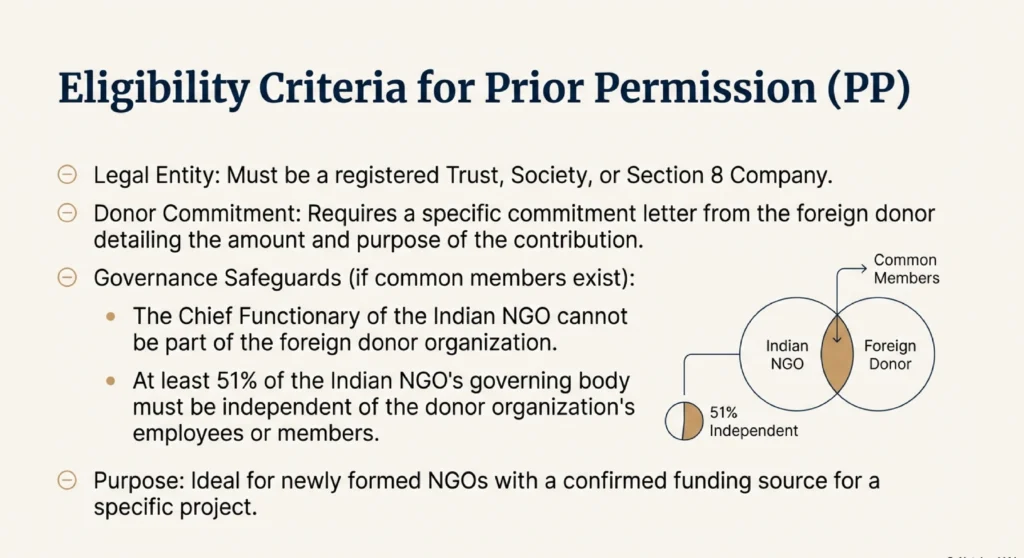

For newer organisations that do not yet have a three-year history, the fcra law provides the Prior Permission (PP) route. This is a form of fcra online registration that allows an NGO to receive a specific amount from a specific donor for a clearly defined project.

Eligibility for Prior Permission FCRA Registration

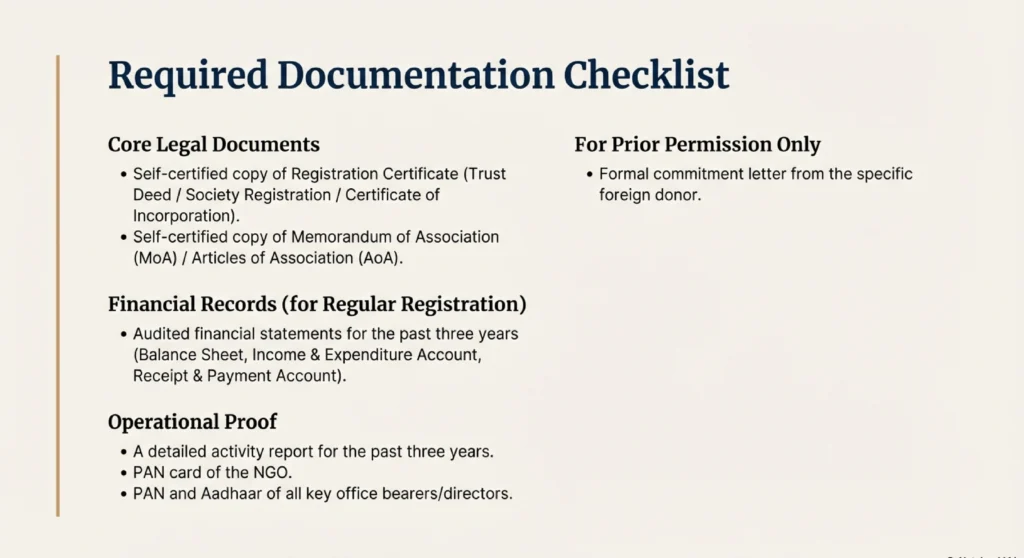

To apply for Prior Permission, the NGO must still be a registered legal entity. Unlike the normal fcra registration, there is no three-year operational requirement. However, the organisation must provide a formal commitment letter from the foreign donor.

Donor Conditions and Compliance under FCRA Law

The fcra law sets strict conditions for Prior Permission to prevent conflicts of interest. If the Indian recipient and the foreign donor have common members, the chief functionary of the Indian NGO cannot be part of the donor organisation. Furthermore, at least 51% of the Indian organisation’s governing body must not be employees or relatives of the donor.

Fundamental Conditions for Granting FCRA Registration

Applicant Integrity and Governance Criteria

The Ministry of Home Affairs meticulously evaluates the integrity of every applicant before granting fcra registration. The applicant must not be fictitious, and their leadership must have a clean record, free from any convictions or pending prosecutions. Any involvement in forced religious conversions or activities that incite communal tension will lead to immediate rejection.

Foreign Fund Utilisation Rules under FCRA Law

Once an organisation receives its fcra clearance, it must follow strict rules regarding fund utilisation. Foreign contributions must be used only for the purposes specified during registration and cannot be diverted for personal gain or undesirable activities. The fcra law also imposes limits on administrative expenses to ensure that the majority of funds reach the intended beneficiaries.

National Interest and Compliance Requirements

The acceptance of funds must not adversely affect India’s sovereignty, territorial integrity, or strategic interests. It must not disrupt friendly relations with foreign states or interfere with the fairness of the democratic process, such as elections. Ongoing compliance is essential, as any violation of the fcra act 2010 can lead to the cancellation of the registration.

Step-by-Step FCRA Registration Process

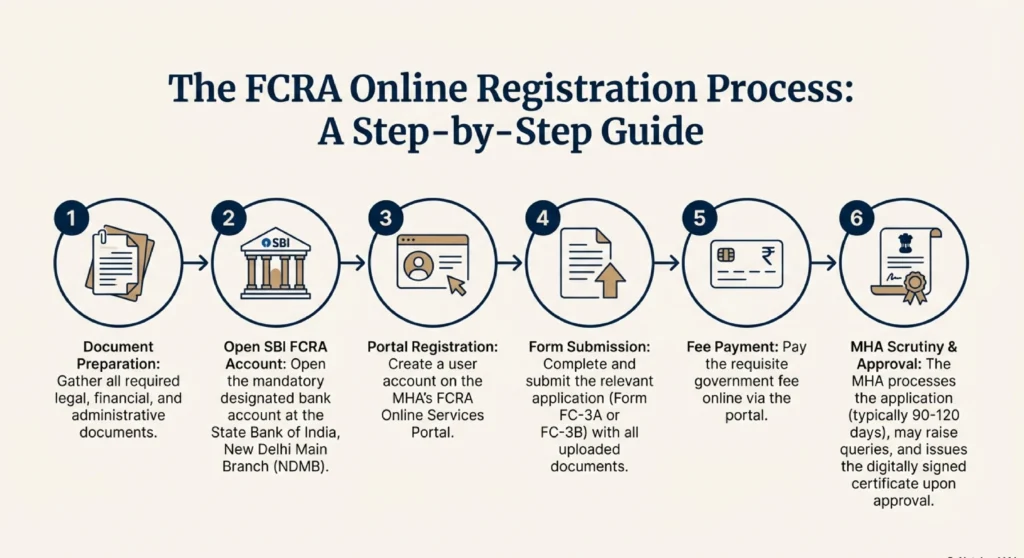

Pre-Application Preparation for FCRA Registration Before starting the fcra registration process, an NGO must ensure its internal records are in order. This includes gathering the registration certificate, PAN cards of the organisation and its members, and Aadhaar numbers for all key office bearers. Accuracy at this stage is critical to avoid delays in the fcra online registration.

Mandatory SBI FCRA Bank Account Requirement

A unique requirement of the fcra law is the mandatory bank account. All registered entities must open a dedicated “FCRA Account” exclusively at the State Bank of India (SBI), New Delhi Main Branch. Only foreign contributions can flow into this account, and domestic funds must never be mixed with them.

Online FCRA Registration Process (Form FC-3A & FC-3B)

The entire fcra registration process is conducted through fcra online services.

- Sign Up: Create a user ID on the official MHA portal.

- Form Selection: Use Form FC-3A for normal registration or Form FC-3B for Prior Permission.

- Details Entry: Fill in association details, executive committee info, and bank details.

- Document Upload: Provide digital copies of all required certificates and reports.

- Submission: Digitally sign the application and submit.

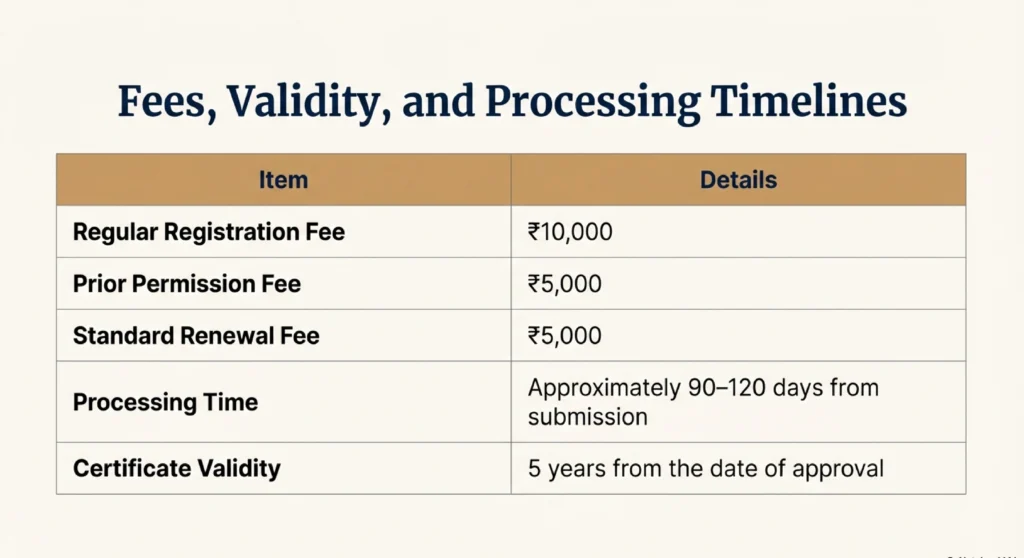

FCRA Registration Fees and Final Submission The final step is the payment of fcra registration fees through the online portal. For normal fcra registration, the fee is Rs. 10,000, while for Prior Permission, it is Rs. 5,000. Once the payment is processed, the application is locked for review by the MHA.

Documents Required for FCRA Registration and FCRA Clearance

Legal and Constitutional Documents

To obtain fcra clearance, an organisation must submit its foundational documents, such as a Trust Deed, Society Registration Certificate, or the Memorandum and Articles of Association (MOA/AOA). These must clearly state the charitable objectives of the association.

Financial Statements and Activity Reports

Applicants must provide audited financial statements (Balance Sheet, Income & Expenditure, and Receipt & Payment accounts) for the last three years. A comprehensive activity report detailing the work done during this period is also essential to prove the organisation’s impact.

NGO Darpan ID Requirement for FCRA Online Services

A modern requirement for using fcra online services is the NGO Darpan ID, obtained from the NITI Aayog portal. This ID is mandatory for filing various forms and helps the government maintain a unified database of active NGOs.

FCRA Validity, FCRA Renewal Process, and FCRA Renewal Status

Validity Period of FCRA Registration

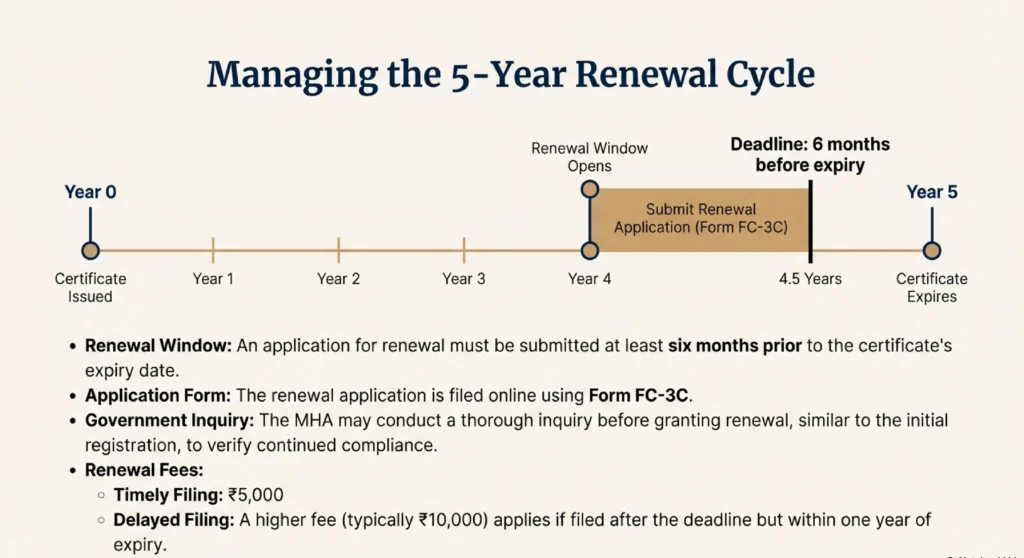

Once granted, an fcra registration is valid for a period of five years. To continue receiving foreign funding, the organisation must proactively apply for fcra renewal before this period expires.

FCRA Renewal Process and Form FC-3C

The fcra renewal process involves filing Form FC-3C on the MHA portal. This application must be submitted at least six months before the expiry of the current certificate. The fcra registration fees for a timely renewal are typically Rs. 5,000.

FCRA Renewal Status, Late Renewal, and Consequences

NGOs can track their fcra renewal status through the online portal using their login credentials. If an application is delayed, the organisation may face a higher fee of Rs. 10,000. If the registration lapses, the organisation is legally barred from receiving or using any foreign funds, and existing unutilised assets may be taken over by the government.

Post-Registration Compliance and FCRA Annual Return

FCRA Annual Return Filing (Form FC-4)

Every registered entity must file an fcra annual return using Form FC-4. This return must be submitted by 31st December each year, covering the previous financial year (April to March). Even if no foreign funds were received during the year, a “Nil” return is still mandatory.

Ongoing Compliance and Reporting under FCRA Law

In addition to the fcra annual return, organisations must inform the MHA of any major changes, such as a change in the bank account, office address, or key members of the governing body. Failure to file the annual return or maintain accurate records can lead to heavy penalties or the suspension of fcra registration.

FCRA Amendment Updates, Rejections, and Challenges

Recent FCRA Amendments and Regulatory Changes

The fcra law has seen a significant fcra amendment in recent years to increase oversight. Notable changes include the mandatory linking of Aadhaar for office bearers, the restriction of administrative expenses to 20%, and the requirement for the SBI New Delhi bank account. These fcra amendment updates aim to prevent the diversion of funds and ensure they reach actual social causes.

Common Reasons for FCRA Registration Rejection

Applications for fcra registration are often rejected due to mismatches in documents, failure to meet the minimum spending threshold, or past non-compliance with reporting rules. Providing outdated financial statements or having a governing body with a questionable track record are also common reasons for a setback in the fcra registration process.

Practical Challenges under the FCRA Act 2010

Critics and NGOs often face challenges such as the rigorous scrutiny of the fcra renewal process and the complexities of the fcra online services. The stringent regulations, while designed for security, can sometimes deter international donors or create administrative burdens for smaller organisations.

Frequently Asked Questions

The full form of fcra is Foreign Contribution (Regulation) Act. It regulates foreign funds to ensure transparency and protect national security.,

Entities registered for three years with Rs. 10,00,000 spent on objectives, excluding administrative costs, qualify for ngo fcra registration.,

This route allows newer organisations to receive specific foreign funds for defined projects before completing three years of active social work.,

All foreign contributions must be received in a mandatory, dedicated account opened at the State Bank of India, New Delhi Main Branch.

An fcra registration certificate remains valid for five years from the date of approval before requiring a formal renewal application.,

fcra registration fees are Rs. 10,000 for normal registration and Rs. 5,000 for obtaining prior permission to receive foreign funds.,

fcra annual return Form FC-4 must be filed online by 31st December annually, covering the previous financial year from April to March.,

Organisations must submit their fcra renewal application at least six months before the current registration certificate’s five-year validity period expires.,

An fcra amendment includes mandatory Aadhaar for office bearers, restricting administrative expenses to 20%, and prohibiting the transfer of foreign funds.

The organisation is barred from receiving or utilising foreign funds, and any unutilised assets may vest with the government authorities.