Section 8 registration offers a formal way to establish a non-profit organization focused on diverse social welfare activities. This comprehensive guide explains the entire legal process under the Companies Act for founders seeking professional NGO status today. You will learn about the required documentation, tax benefits, and mandatory compliance steps for a successful Indian non-profit. This information helps trustees make informed decisions to scale their charitable impact while ensuring complete legal safety.

What Is Section 8 NGO Registration?

A section 8 ngo registration creates a specialized legal entity designed for charitable, educational, or environmental protection work., It allows founders to operate under a corporate structure while focusing purely on their social mission and humanitarian goals. You can complete the section 8 company registration online through the Ministry of Corporate Affairs official digital portal today.

All generated income must be reinvested into the organization to fulfill these objectives rather than paying out any dividends., This registration is the most structured way to establish a non-profit that is recognized throughout the entire country., Modern founders choose this route because it offers a professional image for large-scale social projects and humanitarian efforts.

It ensures that the organization maintains high standards of transparency and accountability for all its various financial transactions. It is ideal for organizations that plan to work with corporate donors or international agencies on significant social initiatives. This structure provides the necessary credibility to attract high-value partnerships and achieve long-term sustainability for your social mission.

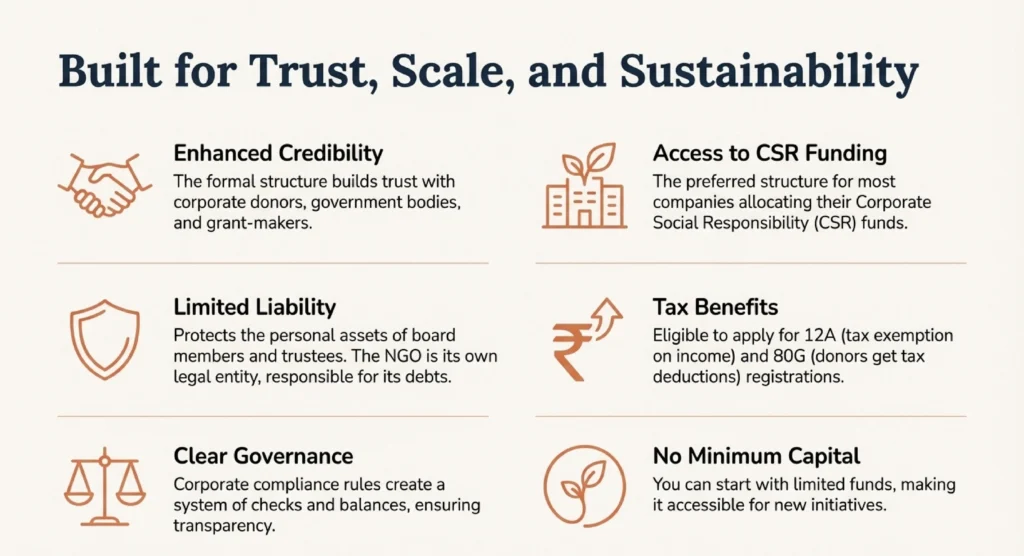

Why NGOs Choose Section 8 Company Structure

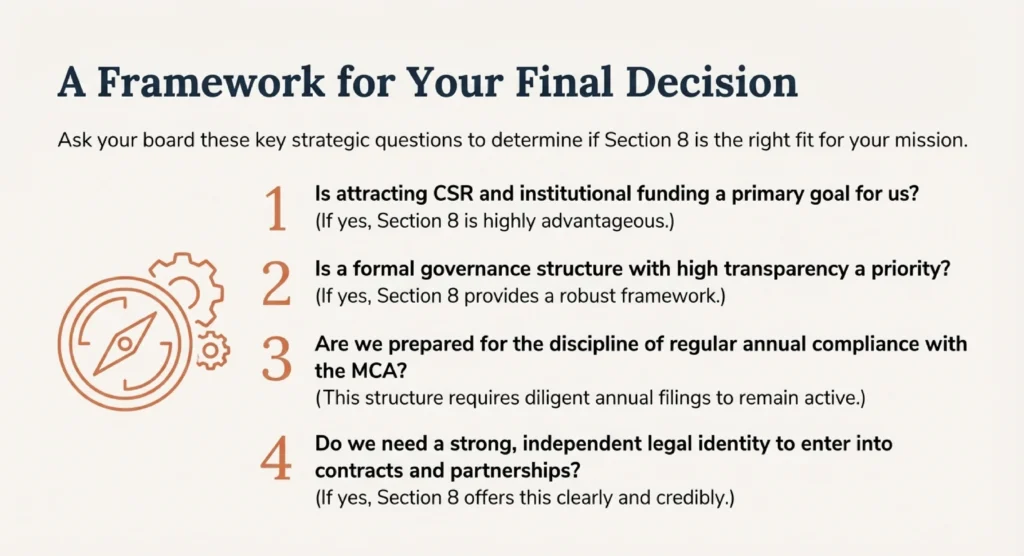

Most founders prefer this structure because it provides limited liability protection for all the members and directors involved., It attracts more donors who trust the rigorous transparency and government oversight associated with the Ministry of Corporate Affairs., Corporate donors prefer this structure because it aligns with their own governance and professional financial reporting standards.

Choosing this structure also makes it easier to obtain essential tax exemptions under the current Income Tax Department rules., Organizations can apply for 12A and 80G certificates to provide tax benefits to their generous supporters and donors., This registration provides a smoother pathway for obtaining FCRA approval to receive foreign contributions for social welfare projects.

| Feature | Section 8 NGO | Private Limited Company |

|---|---|---|

| Primary Objective | Charitable or Social Welfare | Profit Generation and Growth |

| Profit Distribution | Strictly Prohibited to Members | Distributed as Dividends |

| Minimum Capital | No Minimum Requirement | Usually One Lakh Rupees |

| Legal Identity | Separate Legal Entity | Separate Legal Entity |

Many government and private sector projects prefer partnering with these companies due to their high regulatory oversight levels., It offers a scalable platform for founders who wish to create a lasting impact across the entire Indian nation. Perpetual existence ensures that the organization continues its mission regardless of any changes in the board of directors.,

Choosing this structure also makes it easier to obtain essential tax exemptions under the current Income Tax Department rules., Organizations can apply for 12A and 80G certificates to provide tax benefits to their generous supporters and donors., This registration provides a smoother pathway for obtaining FCRA approval to receive foreign contributions for social welfare projects.

Legal Basis Under Companies Act, 2013

Section 8 of companies act 2013 serves as the primary legal framework for creating these non-profit corporate entities., This legislative foundation grants the central government power to issue a special license for operating as a charitable company., Every section 8 company must comply with these rules to maintain its legal status and enjoy ongoing tax benefits.

The law specifies that these companies must apply their profits only toward promoting the charitable objectives of the organization., It prohibits any payment of dividends to members, ensuring all funds remain dedicated solely to the social causes., The government can revoke the license if the company violates any of its primary non-profit charitable objectives.

If a license is revoked, the company may be forced to wind up or merge with another similar organization. This strict legal provision ensures that the non-profit status is not misused for personal gain or unauthorized commercial activities. Understanding these rules is essential for every trustee to ensure long-term organizational compliance and complete legal safety.

Choosing this structure also makes it easier to obtain essential tax exemptions under the current Income Tax Department rules., Organizations can apply for 12A and 80G certificates to provide tax benefits to their generous supporters and donors., This registration provides a smoother pathway for obtaining FCRA approval to receive foreign contributions for social welfare projects.

Eligibility Criteria for Section 8 Registration

To understand who can form a section 8 company, any individual or association of persons can apply for it. You must have at least two directors for a private company or three directors for a public company structure. No minimum paid-up capital is required, making it easier for small groups to start their social impact work.

Founders should be aware of the following basic requirements for a successful application:

- The proposed objectives must focus on promoting art, science, sports, education, research, social welfare, or environmental protection.

- At least one director must be a resident of India who has lived in the country for significant time.

- All directors must possess a valid Director Identification Number and a Digital Signature Certificate to begin the filing process.

The founders must demonstrate a clear intent to use all income for promoting the stated mission of the organization., Applicants should ensure their proposed name is unique and does not conflict with any existing company or trademarked brand. Meeting these basic requirements is the first step toward building a credible and legally sound non-profit organization.

The law specifies that these companies must apply their profits only toward promoting the charitable objectives of the organization., It prohibits any payment of dividends to members, ensuring all funds remain dedicated solely to the social causes., The government can revoke the license if the company violates any of its primary non-profit charitable objectives.

If a license is revoked, the company may be forced to wind up or merge with another similar organization. This strict legal provision ensures that the non-profit status is not misused for personal gain or unauthorized commercial activities. Understanding these rules is essential for every trustee to ensure long-term organizational compliance and complete legal safety.

Choosing this structure also makes it easier to obtain essential tax exemptions under the current Income Tax Department rules., Organizations can apply for 12A and 80G certificates to provide tax benefits to their generous supporters and donors., This registration provides a smoother pathway for obtaining FCRA approval to receive foreign contributions for social welfare projects.

Step-by-Step Section 8 NGO Registration Process

The section 8 company registration process begins by obtaining a Digital Signature Certificate for every proposed director in the NGO., Next, you must reserve a unique name using the RUN form on the official Ministry of Corporate Affairs portal. The incorporation of section 8 company involves filing the SPICe+ form to handle incorporation and tax applications together.

The process generally follows these standard digital milestones:

- Apply for Director Identification Numbers (DIN) for all proposed board members through the government portal.

- Draft the Memorandum and Articles of Association in strict alignment with the organization’s charitable objectives.

- File the application for a license and incorporation along with all necessary supporting documents to the Registrar.

Once the Registrar of Companies verifies all the information, they will issue a special license for your new NGO., Following this, the Certificate of Incorporation is granted, which officially marks the birth of your corporate non-profit entity., Finally, you can register on the NITI Aayog NGO Darpan portal to apply for various government grants.

Documents Required for Section 8 Company Registration

You must provide valid identity proof like a PAN card or Aadhaar card for every director in the organization., Proof of the registered office address is essential, requiring a utility bill that is not more than two months old., If the office is on rented premises, you will need a No Objection Certificate from the property owner.

Founders must prepare the following documents for submission:

- Draft Memorandum of Association (MOA) and Articles of Association (AOA) detailing the social and charitable objectives.

- Passport-sized photographs and bank statements as additional address proof for all the proposed directors and shareholders.

- Declarations from professionals such as Chartered Accountants or Company Secretaries affirming compliance with all legal registration requirements.

Directors are also required to sign a formal declaration stating they have not been disqualified from holding such positions., A project report or a detailed mission statement might be required to explain the planned activities of the NGO. Ensuring all documents are scanned clearly will prevent unnecessary delays during the official government verification and approval process.

How Long Does Section 8 Registration Take?

The entire process of registration generally takes between ten and fifteen working days for most non-profit applicants in India. Obtaining the Digital Signature Certificate and Director Identification Number usually takes about two working days at the very start. Name approval via the RUN form might take another two days depending on the uniqueness of your proposed name.

The final verification and license issuance by the Registrar of Companies typically requires seven to twelve more working days. Total time can vary depending on the workload of the government department and the accuracy of your submitted documents. It is important to respond quickly to any queries raised by the Registrar to avoid extending the overall timeline.

Any errors in the application forms could lead to a resubmission request, which adds several more days to processing. To expedite the registration, ensure that all identity proofs and address documents are current and match the application details. Working with an experienced consultant can help you navigate the portal and manage the timeline more effectively for everyone.

Post-Registration Compliance for Section 8 NGOs

Every registered NGO must hold an Annual General Meeting within six months of the end of the financial year. You are required to file annual financial statements and returns with the Registrar of Companies to maintain legal status., Maintaining these records is crucial for retaining tax exemptions and ensuring continued trust from both the government and donors.,

The following compliance tasks are mandatory for all Section 8 organizations:- Conduct mandatory audits by a qualified chartered accountant to ensure funds are used for the stated social mission.,

- Maintain detailed registers of members, directors, and board meetings held throughout the year for official government inspection.

- File income tax returns annually to retain eligibility for exemptions under sections 12A and 80G of the law.

Failure to comply with these rules can lead to heavy penalties or even the cancellation of your operating license., Staying updated with the latest circulars from the government will help you avoid any accidental legal or financial violations. Regular filings and audits provide the transparency required to attract CSR funding and large-scale international grants for projects.

Documents Required for Section 8 Company Registration

Using a name that is too similar to an existing company can lead to immediate rejection by registration authorities., Inaccurate documentation regarding the registered office address often causes significant delays during the final verification stage of processing. These mistakes are often the result of rushing the application process without doing proper preliminary research and documentation checks.

Avoid these common pitfalls to ensure a smooth registration experience:

- Failing to define charitable objectives clearly in the Memorandum of Association may result in the government denying license approval.,

- Providing incorrect identity details for directors can trigger a resubmission request, which resets the entire application filing timeline.

Another common error is failing to ensure that all digital signatures are valid and registered on the portal correctly. Some applicants forget to attach the mandatory professional declarations from a Chartered Accountant or a qualified Company Secretary. Double-checking every field in the SPICe+ form before final submission can save you weeks of frustration and extra costs.

When Professional Help Is Strongly Recommended

Seeking expert guidance is vital when drafting complex legal documents like the Articles of Association for your new NGO., Professionals help ensure your organization meets all the eligibility criteria required under the current laws and government regulations. They can manage the entire digital filing process, reducing the risk of technical errors that lead to costly rejections.

Professional assistance is especially helpful in the following areas:

- Planning the long-term compliance strategy to keep your organization in good legal standing with all government bodies.,

- Assisting in obtaining important registrations like the Darpan Portal or 12A and 80G certificates for tax benefits.,

- Navigating the complex FCRA registration rules if you plan to receive any form of foreign donations or contributions.,

Experts help you set up robust accounting systems that satisfy the strict audit requirements of the central government. They provide peace of mind by handling the bureaucratic hurdles while you focus on the actual social mission. Choosing the right legal partner ensures your NGO remains compliant while you focus on creating a positive social impact.

Benefits of Section 8 NGO Registration

- Perpetual Existence Keeps Your Mission Alive: Even if founders or board members change, the Section 8 NGO continues without interruption. This ongoing existence is crucial for long-term projects and legacy-building.

- Gives You a Professional Identity: Being registered as a Section 8 Company means you can present yourself with confidence—on letterheads, websites, and campaigns. It shows you’re serious and organized, which makes people want to support you.

- Better Control Over Governance: Section 8 NGOs have to follow certain compliance and governance rules, which helps avoid mismanagement. Clear guidelines and accountability mean your NGO stays focused on its mission.

Opportunity for Wider Collaboration: Many government and private sector projects prefer partnering with Section 8 Companies due to their regulatory oversight. This opens doors for collaboration and funding that might not be available otherwise.

FAQ – Section 8 Company Registration in Delhi

You need at least two directors and two shareholders to register a Section 8 company.

Yes. The entire process of Section 8 NGO registration online can be completed digitally, including e-signatures and document uploads.

Yes, in terms of structure, transparency, and eligibility for funding. It’s best for professionals, corporate-backed NGOs, and high-scale impact work.

Yes, after obtaining FCRA registration from the Ministry of Home Affairs.

Once registered, a Section 8 company has perpetual existence, subject to annual compliances.

Summary

Section 8 NGO registration is the most trusted and structured way to establish a nonprofit in India. With the benefits of legal status, tax exemption, credibility, and CSR eligibility, it offers everything needed to scale your impact. Section 8 company registration in Delhi/NCR is a straightforward process requiring proper documents and guidance.

Whether you’re registering for the first time or looking to convert an existing trust into a company, our team at NGO Partner can assist you with everything — from name approval to final incorporation, PAN/TAN registration, and post-registration compliance.