What is 12A and 80G Registration?

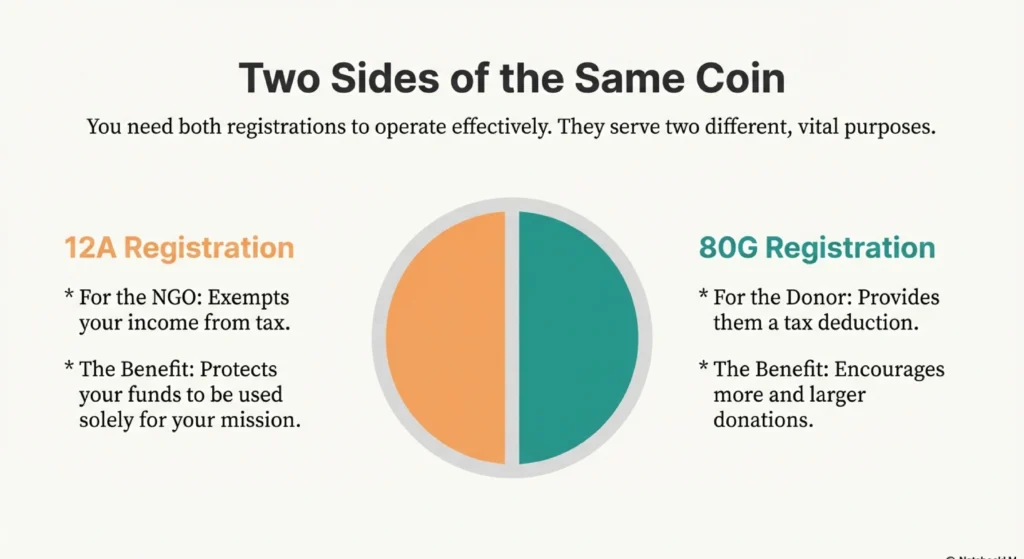

In the world of Indian non-profits, 12a and 80g registration are the two most important certifications an organisation can hold. Under the Income Tax Act, these registrations allow NGOs, trusts, and societies to operate with financial efficiency. Essentially, what is 12a and 80g boils down to two things: tax exemption for the NGO and tax benefits for the people who donate to it. 12A ensures that the money the NGO earns from donations and grants is not taxed by the government, so every rupee can go toward the mission. On the other hand, 80G is a tool that makes your NGO more attractive to donors by allowing them to save on their own taxes when they give to your cause.

What Is 12A and 80G: Income Tax Exemption Under Section 12A/12AA/12AB

Understanding the legal history is helpful for clarity. Section 12A was the original code for institutions registered before 1996, while Section 12AA was used for those registered after that year. Today, the system has transitioned to Section 12AB, which requires all organisations to have a time-bound registration.

Regardless of the specific section name, the goal is the same: to certify that the Income Tax Department recognises your NGO as a legitimate charitable entity. Without this certification, your organisation is treated like a normal business, meaning you would have to pay tax on all the grants and donations you receive. For any NGO aiming for long-term growth, obtaining 12a 80g registration is a fundamental requirement.

Section 80G Registration: Donor Tax Benefits and Fundraising Impact

While 12A helps the NGO keep its money, Section 80G is focused on the donor. When an NGO has 80g and 12a registration, it can issue special receipts to its contributors. These donors—whether they are individuals or large companies—can then claim a tax deduction of either 50% or 100% of the amount they donated. This is a massive boost for fundraising because it provides a financial incentive for people to be generous. It builds a sense of transparency and trust, as donors know that a registered NGO is regularly checked by the tax department.

Why 12A and 80G Registration Is Mandatory for Government Funding

If your NGO plans to work with the government, you cannot skip this step. The law is very clear: only NGOs that have registered under both Section 12A and 80G are eligible for government funding. Whether you are applying for a grant from the Central Government or looking for assistance from a State Government, they will always ask for your registration certificates.

Furthermore, it is a prerequisite for other important legal statuses, such as the Foreign Contribution Regulation Act (FCRA) for international funding and the NGO Darpan portal.

Core Benefits of 12A and 80G Registration

Key Benefits of 12A Registration for NGOs

The primary advantage of 12A is the complete exemption from income tax on the funds your NGO receives. This allows the organisation to use its entire surplus for charitable or religious activities rather than losing a portion to the government. Another significant benefit is the “accumulation of income” rule. An NGO is allowed to set aside up to 15% of its income for future use in its charitable projects without being taxed on that amount. This provides a financial safety net and allows for better long-term planning for welfare projects like education or medical relief.

Key Advantages of 80G and 12A Registration for Donors and CSR Funders

The impact of 80g and 12a registration extends far beyond the NGO itself. For donors, it means their contributions do more than just help a cause; they also reduce their taxable income. For corporate entities, this registration is even more critical. Companies that have Corporate Social Responsibility (CSR) obligations under the Companies Act prefer to donate only to NGOs that have valid 12A and 80G certifications. In fact, having these registrations is the first step toward obtaining a CSR-1 Certificate, which is mandatory if you want to receive CSR funds.

Eligibility Criteria for 80G and 12A Registration

Who Is Eligible to Apply for 12A and 80G Registration?

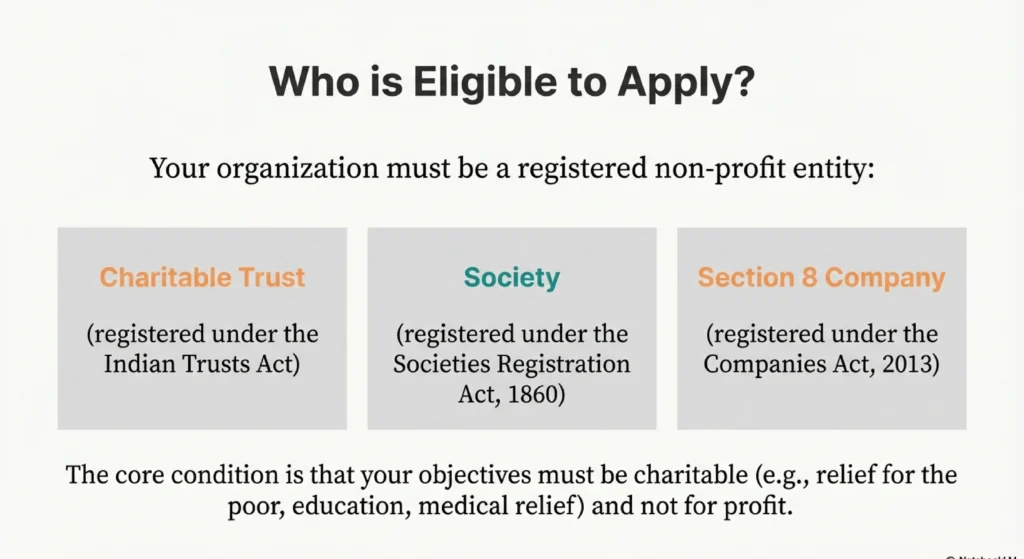

The following entities can apply 12A registration in Delhi and elsewhere across India:

- Charitable Trusts registered under Indian Trusts Act

- Societies registered under Societies Registration Act, 1860

- Section 8 Companies under Companies Act, 2013

- Other not-for-profit or public benefit organizations engaged in charitable, educational, or religious work

It’s common to submit 12A and 80G applications simultaneously, especially when filing online through the Income Tax portal. This saves processing time and ensures consistency in documentation.

Mandatory Conditions for Approval Under 12A and 80G

To get your application approved, you must prove that your NGO has a strictly non-profit motive. Your activities must benefit the public at large and not just a specific group of individuals. Additionally, there are rules regarding “business activities.” If your NGO earns money through business-like services, that income must not exceed 20% of your total receipts to maintain your charitable status. Finally, the income of the NGO must be used exclusively for its stated charitable purposes. If you meet these criteria, you are ready to learn how to apply for 80g and 12a.

Recent Amendments in 12A and 80G Registration Law

Post-Finance Act 2020 Changes in 12A and 80G Registration

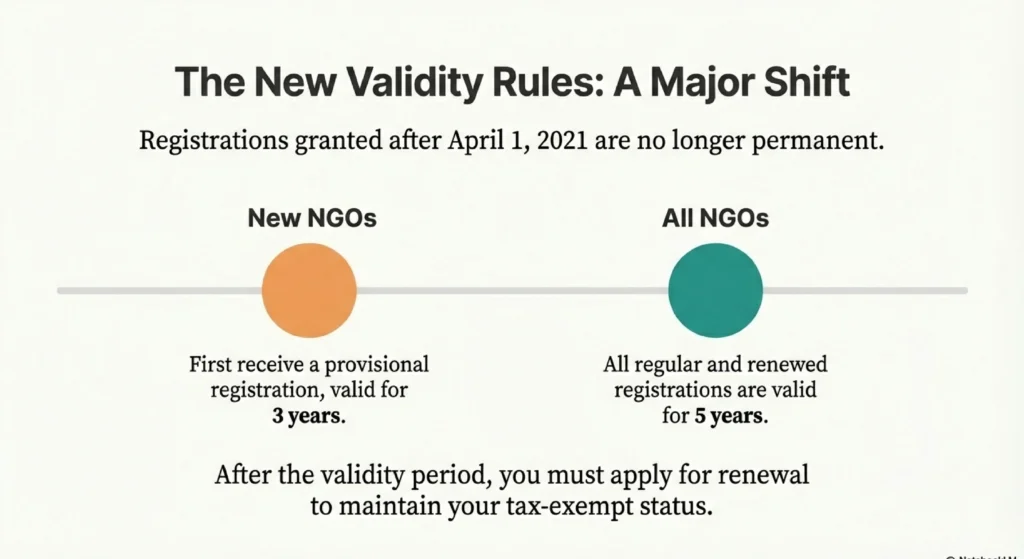

The Finance Act of 2020 introduced the biggest shift in NGO tax laws in decades. Previously, 12A and 80G registrations were often permanent. Now, the government has moved to a time-bound system where every NGO must periodically renew its status. This change was made to ensure that NGOs remain active and continue to perform genuine charitable work.

Provisional 12A and 80G Registration for New NGOs

For brand-new organisations that haven’t started their activities yet, the government provides a “provisional registration”. This is valid for three years. This temporary status allows new NGOs to start fundraising and prove their commitment to their mission before they apply for a regular, long-term registration.

Revalidation Rules for Existing 12A and 80G Registrations

Existing NGOs that had permanent registrations before the 2021 changes were required to “revalidate” their status. This revalidation is valid for five years. Once this five-year period ends, the NGO must apply for a renewal to keep its tax-exempt status alive.

Simultaneous Benefits and Section 10(23C) Compliance

Existing NGOs that had permanent registrations before the 2021 changes were required to “revalidate” their status. This revalidation is valid for five years. Once this five-year period ends, the NGO must apply for a renewal to keep its tax-exempt status alive.

12A and 80G Registration Process Online

Step-by-Step 12A and 80G Registration Process Online

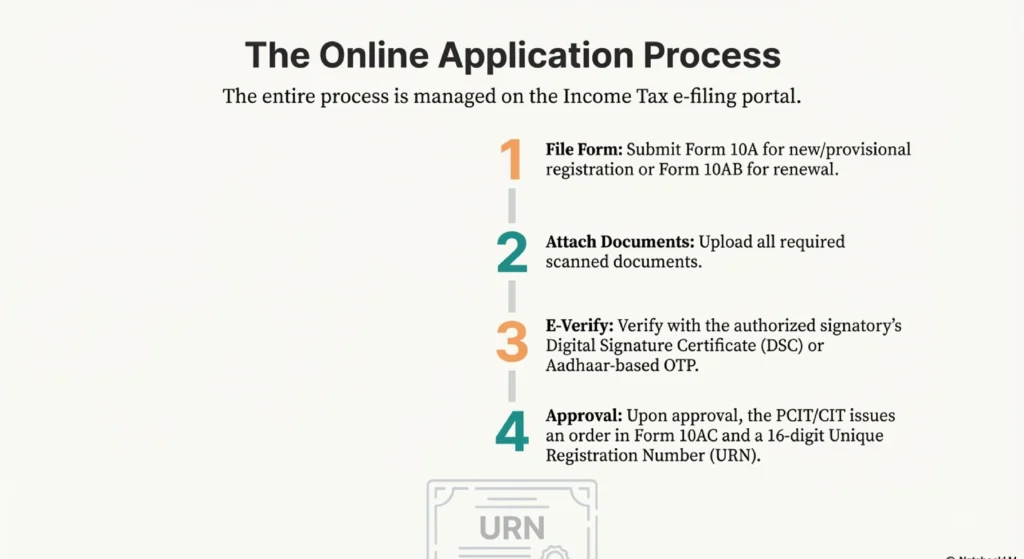

The 12a and 80g registration process online is designed to be transparent and efficient.

1. Portal Access: Log in to the Income Tax Department’s e-filing portal.

2. Form Selection: Select Form 10A for initial registration or Form 10AB for renewals.

3. Submission: Fill in the organisation’s details and upload all required documents.

4. Verification: The form must be e-verified using either a Digital Signature Certificate (DSC) or an Aadhaar-based OTP from the authorised person.

How to Apply for 80G and 12A Using Form 10A and 10AB

Knowing how to apply for 80g and 12a involves using the right forms. Form 10A is generally used for the first time you apply or when you are revalidating an old registration. Form 10AB is the form you will use later when it is time to renew your registration after five years or if you have changed the objectives of your NGO. It is highly recommended to submit 12a and 80g registration applications at the same time to save on processing effort and ensure consistency.

Certificate Issuance After 12A and 80G Registration (URN & Form 10AC)

Knowing how to apply for 80g and 12a involves using the right forms. Form 10A is generally used for the first time you apply or when you are revalidating an old registration. Form 10AB is the form you will use later when it is time to renew your registration after five years or if you have changed the objectives of your NGO. It is highly recommended to submit 12a and 80g registration applications at the same time to save on processing effort and ensure consistency.

Mandatory NGO Darpan Linking for 12A and 80G Registration

One vital part of the 12a and 80g registration process online is the Niti Aayog DARPAN portal. If your NGO wants to receive government grants or apply for 80G status, you must provide your DARPAN registration number in your application. This portal acts as a central database for all NGOs in India, increasing transparency and accountability.

12A and 80G Registration Documents Required

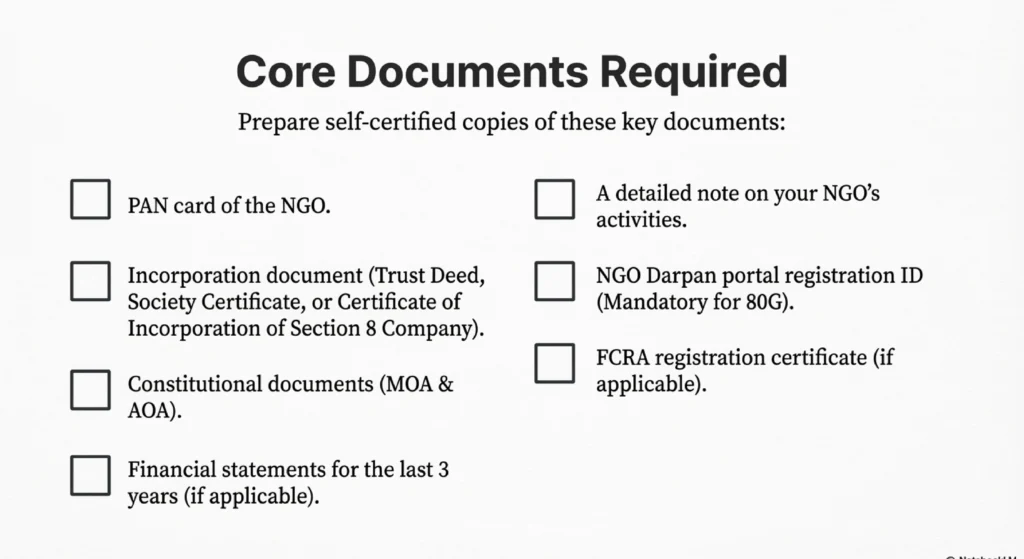

Core Documents Required for 12A and 80G Registration

To ensure a smooth approval, you must have your paperwork in order. The 12a and 80g registration documents required include:

• The self-certified incorporation document (Trust Deed, Society Registration Certificate, or COI for Section 8 companies).

• The PAN card of the NGO.

• The Constitution document (MOA/AOA).

• Valid identity and address proof of the Trustees or Directors.

Financial and Activity Records for 12A and 80G Approval

In addition to legal IDs, the department needs to see what you are actually doing. You must provide:

• Annual financial accounts for the past three years (if the NGO has been active) or estimated budgets for new organisations.

• A detailed note on the activities the NGO has performed or plans to perform.

• Activity reports that highlight your welfare projects.

Trustee and Governing Body Details for 12A and 80G Registration

The tax department also looks at the people running the organisation. You need to provide the contact details, including email and mobile numbers, of all the governing body members. If your NGO is already registered on the DARPAN portal, those details must also be included in the document set.

Timelines, Validity, and Renewal of 12A and 80G Registration

12A and 80G Registration Timelines for New and Existing NGOs

Timing is everything when it comes to compliance. New NGOs should apply for provisional registration at least one month before the start of the assessment year in which they want to claim benefits. For those moving from a provisional to a regular registration, the application must be submitted at least six months before the provisional period expires.

Five-Year Validity Rule for 12A and 80G Registration

The standard rule now is that a regular 12a and 80g registration is valid for five years. This means every five years, the NGO must go back to the tax department and prove they are still doing charitable work.

Renewal of 12A and 80G Registration: Last Date and Filing Rules

The renewal of 12a and 80g registration last date is a critical deadline to track. You must submit your renewal application using Form 10AB at least six months before your current registration expires. Missing this date can lead to a lapse in your tax-exempt status, which can be very expensive for the organisation.

Extended Validity for Small Trusts Under 12A Registration

There is some good news for smaller organisations. For applications made after 31st March 2025, “small trusts”—those with a total income under ₹5 crore—may receive an extended validity of 10 years for their 12AB registration. This is intended to reduce the paperwork burden on smaller NGOs.

Why 80G Registration Always Requires Five-Year Renewal

Even if a small trust gets a 10-year validity for its 12A status, the rule for 80G is different. All institutions must still apply for the renewal of their 80G status every five years. This ensures that the organisations receiving tax-deductible donations from the public are frequently reviewed for transparency.

Special Compliance Scenarios Under 12A and 80G

Changes in NGO Objects and Impact on 12A and 80G Registration

If your NGO decides to change its main goals—for example, moving from just “education” to “medical relief”—you must act quickly. You are required to re-register under Section 12AB within 30 days of making that change. Failure to do so could result in the cancellation of your tax benefits because the department approved you based on your original goals.

Role of 12A and 80G Registration in CSR-1 Eligibility

Holding a valid 12a and 80g registration is the foundation for Corporate Social Responsibility funding. To receive money from companies, you must register on the MCA portal via Form CSR-1, and you cannot do that without having your 12A and 80G certifications first.

Risks of Non-Compliance in 12A and 80G Registration

Loss of Income Tax Exemption Without Valid 12A and 80G Registration

The biggest risk of not having or losing your 12a and 80g registration is financial. Without 12A, the government treats your donations as regular income and taxes them at the full slab rate. This drastically reduces the funds you have available to spend on your mission.

Funding and Donor Risks Due to Lapsed 12A and 80G Approval

A lapse in registration also hurts your fundraising. Donors will not receive tax benefits if your 80G is not active, leading to a massive drop in donor confidence. Furthermore, you will immediately become ineligible for any government grants or corporate CSR partnerships.

Penalties and Cancellation Risks Under 12A and 80G Law

The tax department has the power to cancel your registration if they find you provided “false or incorrect information” or if you are not following other laws. Non-registered NGOs must also file regular business tax returns, and failing to pay tax on donations could result in heavy interest and legal penalties.

Conclusion: Expert Support for 12A and 80G Registration

Why Professional Help Matters in 12A and 80G Registration Process

As you can see, the laws surrounding 12a 80g registration are complex and filled with strict deadlines. Even a small error in documentation or missing the renewal of 12a and 80g registration last date can have devastating consequences for your NGO. Professionals can help ensure that your application is 100% compliant and that you respond to any queries from the tax department quickly and accurately.

Choosing the Right Compliance Partner for 12A and 80G Registration

When looking for help, it is important to find a partner that understands the unique needs of non-profits. While many wonder about the specific 12a and 80g registration fees, it is best to look for a partner that offers transparent pricing with no hidden costs. A good partner will handle everything from document review to the final issuance of your 16-digit URN, allowing you to focus on your mission of making a positive impact on society.

Don’t let tax liabilities or donor hesitation hold your organization back. With our expert legal assistance, you can complete your online apply for 12A and 80G registration quickly and affordably.

Whether you’re starting a new NGO, trust, or Section 8 company or are looking to upgrade your existing documentation, NGO Partner is here to help. Our team is committed to delivering 100% compliant, smooth, and fast 12A and 80G registration services across India.

📞 Call Us Today: +91-7210449958

📩 Email Support: info@ngopartner.co.in

🌐 Explore More Services:

Also check out our support for:

- NGO Registration

- Trust Registration

- Society Registration

- FCRA Registration

- Educational Institute Setup

Let us help you build an NGO that is tax-exempt, donation-ready, and fully compliant.

Frequently Asked Questions for 12A and 80G Registration

12A registration exempts an NGO’s own income (donations and grants) from being taxed by the government. Conversely, 80G registration provides a tax benefit to the donors, allowing them to claim a deduction on the contributions they make to the NGO.

Yes, it is highly recommended to apply 12A and 80G registration online simultaneously. Doing so ensures consistency in documentation and saves significant processing time for the organisation.

New organisations are initially granted a provisional registration valid for three years. Regular or revalidated registrations are generally valid for a period of five years, after which they must be renewed.

To ensure continued tax benefits, the renewal of 12a and 80g registration last date is at least six months prior to the expiry of your current registration. Failure to meet this deadline can result in the loss of tax-exempt status.

Form 10A is utilised for the initial provisional registration or the revalidation of existing old certificates. Form 10AB is required for the renewal of registration after the five-year period or when there is a modification in the NGO’s objectives.

The 12a and 80g registration documents required include the NGO’s PAN card, incorporation documents (Trust Deed, Society Certificate, or COI), three years of financial statements, activity reports, and the identity proofs of the Trustees or Directors.

Yes, providing a DARPAN ID from Niti Aayog is mandatory for NGOs applying for 80G registration and is highly recommended for 12A, especially if the organisation intends to seek government grants.

No, registration under both Section 12A and 80G is strictly mandatory for any NGO that intends to receive grants or financial assistance from the Central or State Government.

If an NGO is not registered, its entire surplus income, including all voluntary contributions and grants, is treated as fully taxable income at the applicable slab rates.

If there is any change in the objectives of the NGO, it is mandatory to apply for re-registration under Section 12AB within 30 days of that modification to maintain tax-exempt status.

For applications made after 31st March 2025, “small trusts” with an annual income below ₹5 crore may receive an extended 10-year validity for 12A registration, though their 80G status must still be renewed every five years.