NGO Partner simplifies FCRA registration for Indian organizations seeking foreign donations. Our guide covers eligibility, procedure for FCRA registration, documents, and FCRA registration fees. Learn the steps, benefits, and compliance requirements to unlock global funding. Start your FCRA registration procedure with expert support today.

What is FCRA?

The Foreign Contribution Regulation Act (FCRA) governs foreign donations in India. Enacted in 1976 and amended in 2010, it ensures transparency. The Ministry of Home Affairs (MHA) oversees compliance. Organizations must register to receive foreign funds legally. Non-compliance risks penalties or cancellation. FCRA registration is vital for NGOs.

What is FCRA Registration?

FCRA registration allows Indian entities to accept foreign contributions. It’s mandatory under Section 11 of the FCRA, 2010. Without registration, prior permission is needed for specific projects. The process involves detailed documentation and compliance checks. NGO Partner streamlines the procedure for FCRA registration for seamless approval.

Normal Registration

Normal registration suits established organizations. They must operate for three years. A minimum expenditure of Rs. 10,00,000 is required. This excludes administrative costs. Eligible entities include those under the Societies Registration Act, 1860. Indian Trusts Act, 1882, or Section 8 Companies also qualify. Audited financials are mandatory.

Prior Permission for FCRA New Registration

New organizations opt for prior permission. It’s ideal for entities under three years old. A donor commitment letter is essential. It must specify the donation amount and purpose. The Chief Functionary cannot be part of the donor organization. At least 75% of governing body members must be independent.

Benefits of Registering under the FCRA Act

FCRA registration unlocks global funding. It enables donations for social, cultural, or educational programs. Transparency in fund usage builds trust. Registered entities may enjoy tax exemptions. Legal protection ensures compliance. NGO Partner helps organizations maximize these benefits. The FCRA registration procedure enhances credibility and impact.

Eligibility Criteria for FCRA Registration

Eligibility for FCRA registration requires legal registration. Qualifying statutes include the Societies Registration Act, 1860. The Indian Trusts Act, 1882, is also valid. Section 8 Companies under the Companies Act, 2013, qualify too. Organizations need three years of operations. They must spend Rs. 10,00,000 on core activities.

Eligibility for FCRA Prior Permission

New entities can apply for prior permission. They must be legally registered. A donor commitment letter is required. It details the contribution’s purpose and amount. The Chief Functionary must be independent. At least 75% of the governing body cannot overlap with the donor. NGO Partner ensures compliance.

What Constitutes Foreign Contribution?

Foreign contributions include currency, articles, or securities. Personal gifts under Rs. 25,000 are exempt. Interest earned on foreign funds counts. Securities fall under the Securities Contracts Act, 1956. The Foreign Exchange Management Act, 1999, also applies. Proper tracking ensures compliance with FCRA registration rules.

Conditions for Registration or Prior Permission

Applicants must not be fictitious. They cannot promote religious conversions forcibly. Communal disharmony is prohibited. Sedition or violent activities disqualify applicants. Funds must not harm India’s sovereignty. Contributions cannot incite offenses. A strong track record is essential. NGO Partner ensures adherence to these conditions.

Mandatory Requirements for NGO FCRA Registration

NGOs need legal registration. A unique NGO Darpan ID is mandatory. An FCRA bank account is required. It must be with the State Bank of India. Aadhaar numbers of office bearers are needed. Foreign members submit passports or OCI cards. NGO Partner simplifies these steps.

FCRA Registration Documents Required

NGOs need legal registration. A unique NGO Darpan ID is mandatory. An FCRA bank account is required. It must be with the State Bank of India. Aadhaar numbers of office bearers are needed. Foreign members submit passports or OCI cards. NGO Partner simplifies these steps.

Normal FCRA Registration

NGOs need legal registration. A unique NGO Darpan ID is mandatory. An FCRA bank account is required. It must be with the State Bank of India. Aadhaar numbers of office bearers are needed. Foreign members submit passports or OCI cards. NGO Partner simplifies these steps.

Prior Permission FCRA Registration

Submit the registration certificate. Include the Memorandum of Association or Trust Deed. The NGO Darpan ID is mandatory. Aadhaar cards of key officials are required. A donor commitment letter is crucial. A detailed project report must be included. NGO Partner ensures all documents are accurate.

Renewal of FCRA Registration

FCRA registration lasts five years. Renewal applications must be filed six months before expiry. The MHA oversees the process. Updated documents are required. Non-compliance risks cancellation. NGO Partner tracks renewal status. This ensures uninterrupted foreign funding. Timely renewal is critical for NGOs.

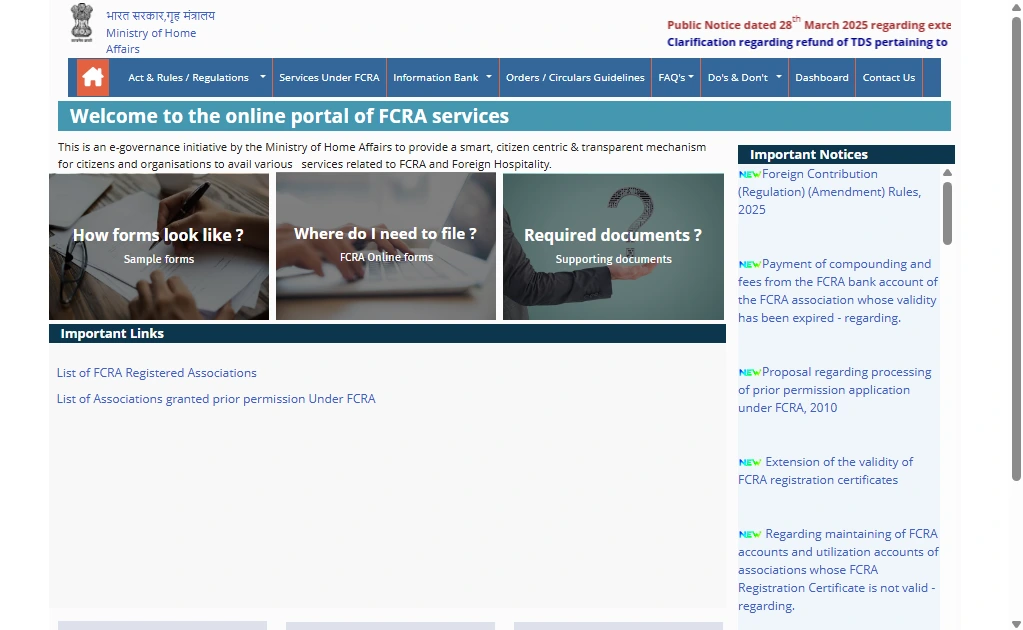

FCRA Online Registration Process: Step-by-Step Guide

The FCRA registration procedure is straightforward with guidance. Follow these steps to apply online. NGO Partner ensures a smooth process. Compliance with MHA guidelines is guaranteed. Below is the detailed procedure for FCRA registration.

- Visit the FCRA portal at fcraonline.nic.in.

- Click “Sign Up” to create a login ID.

- Log in using your credentials.

- Select “I am applying for” from the dropdown.

- Choose FC-3A for normal registration.

- Select FC-3B for prior permission.

- Pick FC-3C for renewal applications.

- Fill out the FC-3 form with association details.

- Enter registration number and date.

- Provide the NGO Darpan ID.

- Specify the nature of the association.

- Add Executive Committee details.

- Use “Add details of Key Functionary” to edit.

- Save the committee information.

- Enter FCRA bank account details.

- Include bank name and IFSC code.

- Upload documents in PDF format.

- Review all details carefully.

- Enter place and date.

- Click “Final Submission” to proceed.

- Pay the FCRA registration fees online.

- Track application status on the portal.

| Registration Type | Fee (INR) | Processing Time | Notes |

|---|---|---|---|

| Normal Registration | 5,000 | 3-6 months | For organizations with 3+ years |

| Prior Permission | 2,500 | 2-4 months | For new entities or specific projects |

| Renewal | 1,500 | 2-3 months | Must apply 6 months before expiry |

FCRA Annual Return and Quarterly Return Filing for NGOs Receiving Foreign Donations

NGOs must file annual returns. Form FC-4 is used. It covers April 1 to March 31. Submission is due by December 31. A certified balance sheet is required. A statement of receipts is mandatory. Quarterly returns apply if funds exceed Rs. 1 crore. NGO Partner ensures timely filing.

FCRA Bank Account

An FCRA bank account is mandatory. It must be with the State Bank of India. Only foreign contributions are allowed. Domestic transactions are prohibited. Account activation takes seven days. NGO Partner assists with account setup. Compliance with RBI guidelines is ensured.

Simplify FCRA Registration with NGO Partner!

The FCRA registration procedure can be complex. NGO Partner makes it effortless. Our experts handle documentation and compliance. We track application status in real-time. Normal registration or prior permission is streamlined. Renewal support is also provided. Focus on your mission. Let us manage the legalities.

- Expert guidance for FCRA registration.

- Transparent pricing with no hidden costs.

- Compliance with MHA regulations.

- Real-time status updates.

Contact NGO Partner to start your procedure for FCRA registration today. Unlock global funding with ease.

FCRA Registration FAQ’s

It allows NGOs to receive foreign donations legally. Compliance with FCRA, 2010, is mandatory.

Normal registration costs Rs. 5,000. Prior permission is Rs. 2,500. Renewal fees are Rs. 1,500.

Visit the FCRA portal. Create a login. Submit Form FC-3A or FC-3B. Upload documents. Pay fees.

Log in to the FCRA portal. Check application status. NGO Partner provides real-time updates.

Use the FCRA portal’s public search tool. Enter the organization’s details.

Include registration certificate, audited financials, and Darpan ID. Prior permission needs a donor letter.

Yes, for non-compliance or prohibited activities. Timely renewals prevent cancellation.

File Form FC-3C six months before expiry. Submit updated documents.

Use a dedicated SBI account. Only foreign funds are allowed.

Check the FCRA portal’s verification tool. Contact MHA for confirmation.