Non-Governmental Organizations (NGOs) in India often rely on international support to fund their social, educational, medical, and charitable programs. To legally receive such foreign donations, they must undergo FCRA Registration, governed by the Foreign Contribution Regulation Act (FCRA), 2010. The FCRA Registration for NGOs ensures transparency and accountability in utilizing foreign funds while adhering to national interests and compliance guidelines.

Suppose you are planning to start an NGO or already running one and want to receive international donations. In that case, this comprehensive guide will walk you through the procedure for FCRA registration, eligibility, documentation, online process, FCRA registration fees, and more.

At NGO Partner, a Delhi-based legal services provider, we specialize in helping NGOs across India with everything from online FCRA registration for NGOs to 12A & 80G, NGO Darpan, e-Anudan, CSR-1, and more.

What is FCRA Registration?

The Foreign Contribution Regulation Act (FCRA) is a law that regulates the acceptance and utilization of foreign contributions or hospitality by individuals, associations, or companies. NGOs, charitable trusts, societies, and Section 8 companies receiving donations from abroad must mandatorily register under FCRA.

There are two types of FCRA Registration:

- Normal/Regular Registration

- Prior Permission Registration

Let’s explore each and understand when your NGO should apply for either.

Types of FCRA Registration for NGOs

1. Regular FCRA Registration

This is for NGOs that:

- Are more than 3 years old

- Have conducted significant activities in the past 3 years

- Have spent at least ₹10 lakh in voluntary activities (excluding administrative costs)

2. Prior Permission Registration

If the NGO:

- Is newly established or less than 3 years old

- Has a specific donor and clearly defined purpose for foreign contribution

Then, it can apply for Prior Permission under FCRA. This is valid for a specific purpose, amount, and donor.

- Enhanced Visibility: Registered organizations gain visibility on the government’s FCRA website, promoting transparency in fund utilization.

- Legal Compliance: Compliance with FCRA regulations ensures that organizations operate within legal frameworks, avoiding legal issues.

- Opportunities for Growth: FCRA-registered entities can pursue larger-scale projects, contributing to more significant societal changes.

- Financial Accountability: The registration process promotes financial accountability, ensuring that foreign funds are utilized for their intended charitable purposes.

Eligibility for FCRA Online Registration

To apply for FCRA online registration, the NGO must meet the following conditions:

- The NGO must be registered under the Societies Registration Act, Trust Act, or Companies Act (Section 8).

- It should not be a benami or fake entity.

- The organization must not use foreign donations for personal gain or political motives.

- There must be no pending legal cases against the NGO or its executive members.

- The entity must have an FCRA designated bank account opened with SBI, New Delhi Branch as mandated by the Ministry of Home Affairs (MHA).

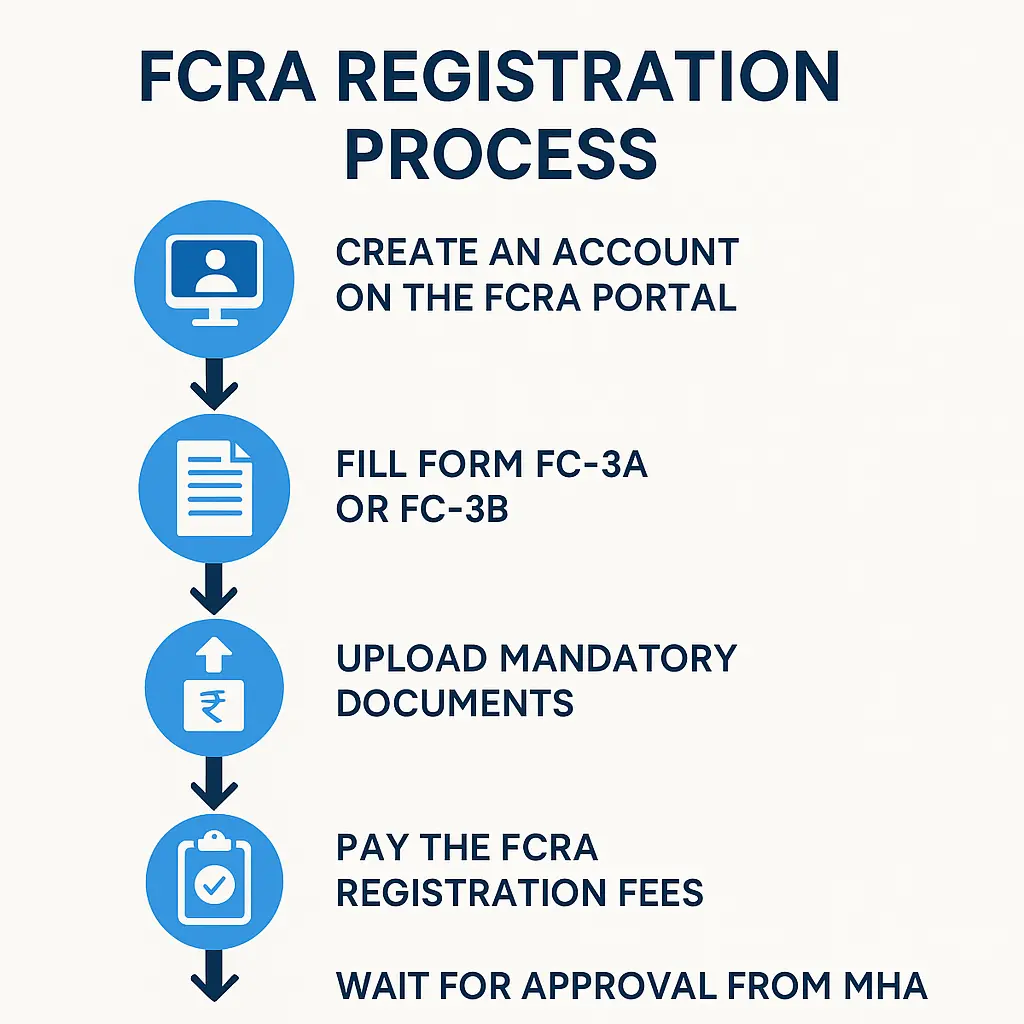

Step-by-Step Procedure for FCRA Registration

Step 1: Create an Account on the FCRA Portal

Visit the FCRA Online Services and register as an NGO by creating a user ID and password.

Step 2: Fill Form FC-3A or FC-3B

- FC-3A for Regular Registration

- FC-3B for Prior Permission

Fill in the required details, such as:

- Name and registration details of NGO

- Contact details

- PAN of organization

- Details of key functionaries

- Bank account details (FCRA account with SBI, New Delhi)

Step 3: Upload Mandatory Documents

- Certificate of Registration (Trust Deed/Society/Section 8)

- MOA & Rules

- Audited financial statements for the last 3 years

- Activity report for the last 3 years

- PAN card of NGO

- Affidavit/Declaration of all key members

- Commitment letter from foreign donor (in case of prior permission)

Step 4: Pay the FCRA Registration Fees

- ₹10,000 for Regular FCRA Registration

- ₹5,000 for Prior Permission

Fees are to be paid online on the FCRA portal.

Step 5: Wait for Approval from MHA

The Ministry of Home Affairs (MHA) will verify the application and issue an FCRA certificate, generally within 3-6 months. You can track the status online using your FCRA login credentials.

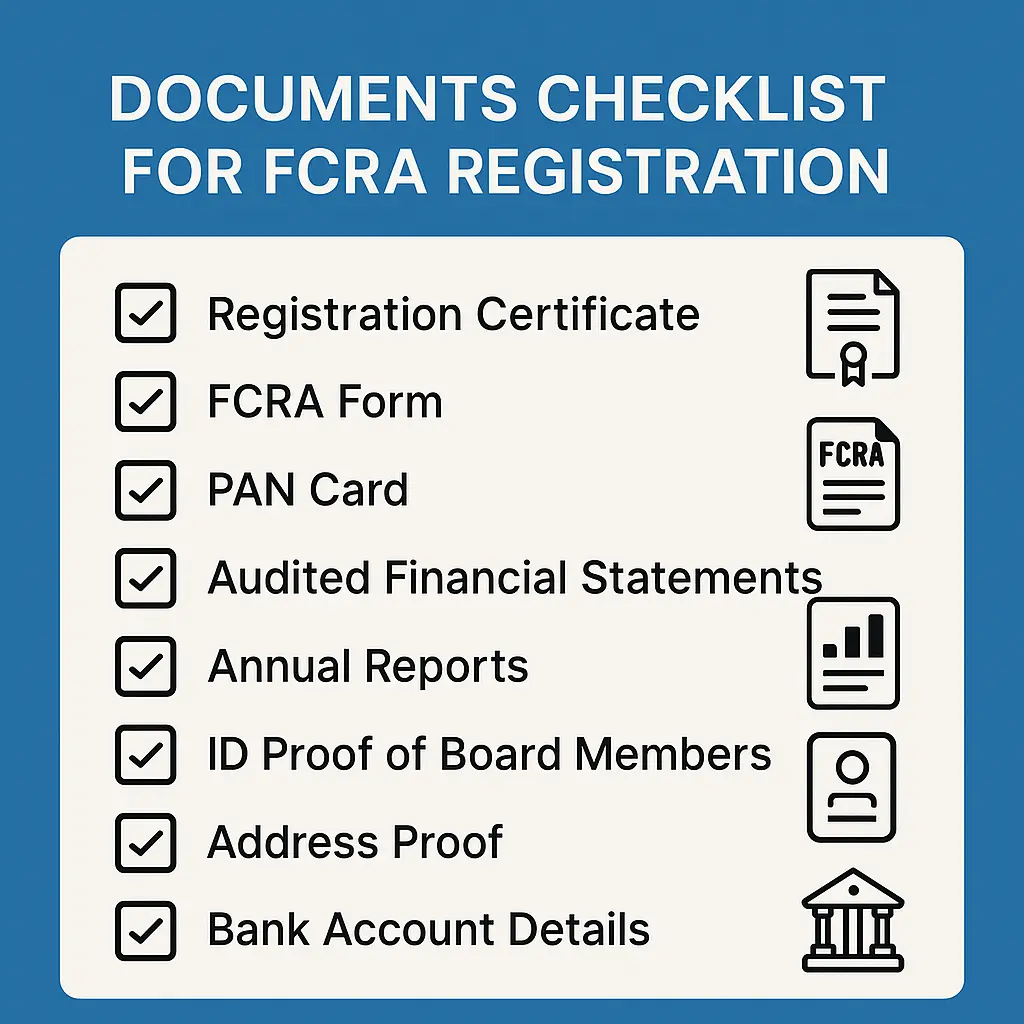

Documents Required for FCRA Online Registration

Here is a checklist for your online FCRA registration for NGO:

- NGO Registration Certificate

- PAN card of NGO

- Trust Deed or MOA & AOA

- Financial statements of last 3 years

- Activity reports

- Details of governing body members

- FCRA bank account with SBI, ND

Common Mistakes to Avoid During FCRA Registration Procedure

- Providing incomplete or mismatched data

- Failing to open the required SBI New Delhi FCRA account

- Uploading blurred or expired documents

- Applying without verifying signatures

- Delayed response to MHA clarifications

Avoiding these pitfalls ensures a smoother process and avoids unnecessary delays or rejections.

Why Choose NGO Partner for Online FCRA Registration in India?

At NGO Partner, we offer expert legal and compliance support to help you register and maintain your FCRA status without hassles. Our dedicated legal team helps NGOs across India with the following:

- Accurate documentation

- Expert online application filing

- Opening the correct FCRA-compliant bank account

- Timely MHA coordination and response

- Affordable and transparent service packages

We ensure end-to-end support from consultation to approval.

Benefits of Getting FCRA Registration

1.You Can Legally Accept Foreign Funds: Once your NGO is FCRA registered, you can officially receive donations from abroad — no questions asked. It keeps everything above board and smooth with the government.

2.It Shows Your NGO Is Serious and Trustworthy: Registration under FCRA signals that your organization follows rules and cares about transparency. Donors feel more confident when they know you’re compliant.

3.Doors Open to Global Grants and Foundations: FCRA makes it possible for you to apply for international grants — from UN agencies to private global trusts. That’s funding you couldn’t even consider without it.

4.You Get a Strong Base to Expand Your Work: With regular foreign support, your NGO isn’t just surviving — it’s planning ahead, growing, reaching more people, and scaling up long-term projects.

5.You Build a Culture of Clean Financial Practices: FCRA compliance encourages detailed bookkeeping, clear audits, and responsible spending. It trains your whole team to stay financially sharp.

6.It Strengthens Your Standing with Authorities: When you’re FCRA registered, government departments recognize your NGO as legitimate. You’ll find it easier to collaborate or get permissions for your programs.

7.You’re Ready When Emergencies Strike: In times of disasters or urgent needs, foreign relief funds often come fast. Only FCRA-approved NGOs can accept and distribute those funds legally in India.

8.People Are More Likely to Trust You: Being listed as a registered FCRA NGO builds social trust. Donors, journalists, partners — they can verify your status and see that you’re doing things the right way.

9.You Attract Better Talent and Partnerships: Serious professionals — from finance heads to program officers — prefer working with compliant NGOs. FCRA shows your NGO is organized and future-focused.

You Become Part of a Global Network: FCRA registration helps you connect with like-minded groups and international institutions. You’re no longer just a local NGO — you’re part of the global development space.

Also Need 12A & 80G Registration for NGOs

To get income tax exemptions and attract Indian donors with tax deduction benefits, NGOs must register under Sections 12A & 80G of the Income Tax Act.

At NGO Partner, we help NGOs apply for 12A to gain tax exemption status and 80G to allow donors to claim tax deductions. The process includes preparing financial records and activity reports and applying via the Income Tax portal.

If your NGO plans to apply for FCRA, having 12A & 80G enhances credibility during the MHA review.

Learn more about our 12A & 80G Registration Services →

Renewal and Validity of FCRA Registration

- FCRA Certificate is valid for 5 years

- Renewal must be applied for at least 6 months before expiry using Form FC-3

- Failure to renew on time will result in cancellation

NGOs must ensure they submit annual returns (FC-4), maintain proper books of accounts, and report foreign funds to MHA annually.

Frequently Asked Questions (FAQs)

NGOs and organizations in India engaging in charitable, social, religious, economic, or cultural activities and seeking foreign contributions require an FCRA (Foreign Contribution Regulation Act) certificate. This legal document ensures legitimacy and compliance with regulations for receiving funds from foreign sources.

For FCRA registration, essential documents include legal registration certificates, audited financial statements, project reports, and updated information about key office-bearers. Accurate documentation is crucial for compliance with FCRA regulations, ensuring the organization’s eligibility to receive foreign contributions legally.

FCRA (Foreign Contribution Regulation Act) registration is initially valid for five years. Organizations need to apply for renewal six months before the expiry date to continue legally receiving foreign contributions. Renewal is subject to compliance with FCRA regulations and updated documentation.

Yes, FCRA (Foreign Contribution Regulation Act) registration is compulsory for organizations in India intending to receive foreign contributions for charitable, social, economic, cultural, or religious activities. It ensures transparency and compliance with legal regulations in handling funds from foreign sources.

Any NGO, Trust, Society, or Section 8 Company that wishes to receive foreign donations legally must apply for FCRA registration.

A new NGO can apply for Prior Permission under FCRA if it has a specific donor and a defined purpose for foreign funding.

1.₹10,000 for Regular FCRA Registration

2.₹5,000 for Prior Permission

1.₹10,000 for Regular FCRA Registration

2.₹5,000 for Prior Permission

Every NGO applying for FCRA must open a dedicated bank account in the SBI Main Branch, New Delhi, to receive foreign contributions.

Failure to renew your FCRA registration will lead to automatic cancellation, and you will not be able to receive foreign contributions.

Summary

The procedure for FCRA registration is a structured and compliance-driven process that enables Indian NGOs to receive foreign contributions lawfully. Whether you’re opting for regular or prior permission-based FCRA registration, following the correct steps and submitting the right documents is crucial.

By choosing NGO Partner, your Delhi-based expert in online FCRA registration for NGOs, you get end-to-end support from application to approval, ensuring a seamless and compliant experience. Don’t let paperwork or legal complexities hold your cause back—partner with us today for hassle-free registration.

Also explore our services in 12A & 80G Registration, NGO Audit, and FCRA Annual Return Filing to complete your NGO compliance journey.